Direxion Daily S&P 500 Bull 3X Shares (SPXL)

220.19

+5.60 (2.61%)

NYSE · Last Trade: Dec 22nd, 2:53 AM EST

Explore how sector concentration and volatility set these two leveraged ETFs apart for traders seeking different risk profiles.

Via The Motley Fool · December 21, 2025

Explore how sector focus and holdings concentration set these leveraged ETFs apart for risk-aware traders.

Via The Motley Fool · December 21, 2025

Explore how differences in leverage, risk, and cost between SPXL and SSO can impact your approach to S&P 500 trading strategies.

Via The Motley Fool · December 20, 2025

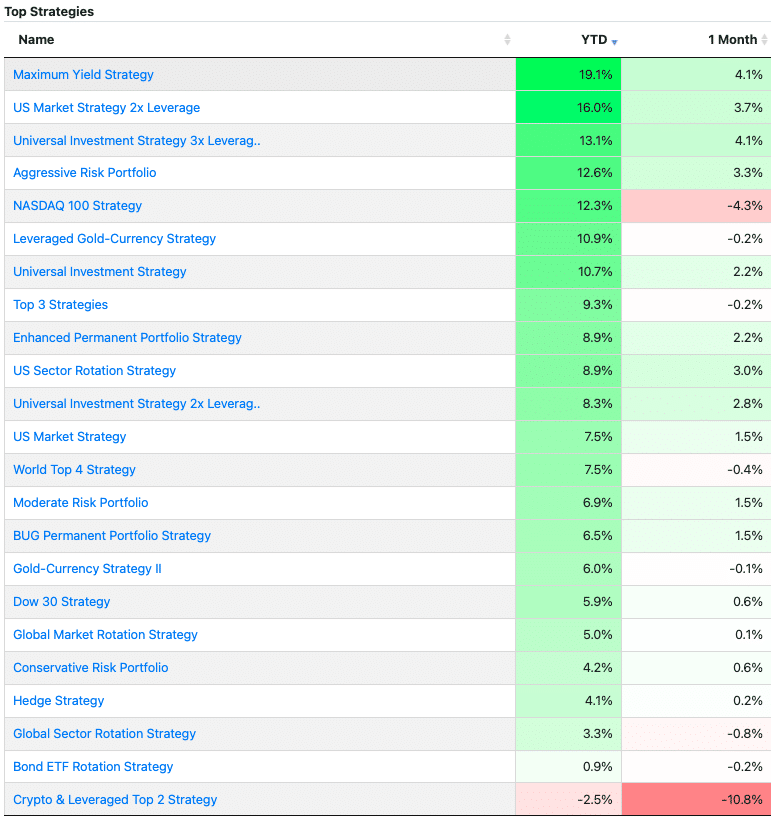

Strategy returns year-to-date as well as the monthly returns.

Via Talk Markets · July 2, 2024

QLD and SPXL Offer Distinct Leverage for Growth Investors

Via The Motley Fool · November 8, 2025

SPXL and TQQQ both offer daily 3x leveraged exposure, but SPXL focuses on the S&P 500 while TQQQ targets the tech-heavy Nasdaq-100, leading to deeper drawdowns for TQQQ.

Via The Motley Fool · November 5, 2025

TQQQ and SPXL Compare Tech Focus Versus Broad Market

Via The Motley Fool · November 3, 2025

Leveraged ETFs see a 74% inflow as investor risk appetite hits a multi-year high despite Trump induced tariff lows from April.

Via Benzinga · October 2, 2025

ProShares launches URSP, a 2x leveraged S&P 500 Equal Weight ETF, offering investors big returns without Big Tech concentration risk.

Via Benzinga · August 28, 2025

This ETF is trying to beat the market on a daily basis.

Via The Motley Fool · June 25, 2025

ETF expert Mo Sparks joins Direxion as Chief Product Officer, signaling a focus on innovation in trading. Sparks brings a wealth of experience and a vision for product expansion.

Via Benzinga · April 1, 2025

As risk-taking builds and is rewarded by higher prices, risk-taking morphs into more extreme speculation. For example, the surge of capital into 3x Leveraged S&P 500 ETFs has been remarkable.

Via Talk Markets · November 30, 2024

For investors expecting markets to continue to rise into the new year and administration, broad-based leveraged funds offer short-term potential.

Via MarketBeat · November 25, 2024

Via Benzinga · November 20, 2024

The SPDR S&P 500 (NYSE: SPY) reached a new all-time high of $526.80 on Wednesday after the Consumer Price Index (CPI) showed inflation pressures eased in April.

Via Benzinga · May 15, 2024

The SPDR S&P 500 (NYSE: SPY) was falling about 0.25% lower Wednesday ahead of the Federal Reserve’s decision on interest rates.

Via Benzinga · May 1, 2024

The SPDR S&P 500 (NYSE: SPY) was rising about 0.3% Wednesday amid persistent optimism that the Federal Reserve will cut intere

Via Benzinga · April 3, 2024

Via Talk Markets · March 26, 2024

Although inflation fears cloud the SPDR S&P 500 ETF Trust, unless hard evidence states otherwise, the SPY ETF is a long trade.

Via InvestorPlace · February 29, 2024

The S&P 500 breached the 5000 mark Friday after flirting with the record-breaking level on Thursday, buoyed by increasing positive sentiment that the Federal Reserve will apply six rate cuts this year.

Via Benzinga · February 9, 2024

The SPDR S&P 500 (NYSE: SPY) was inching slightly higher Wednesday, continuing to consolidate Monday’s 1.43% surge, which was driven by consumer inflation expecta

Via Benzinga · January 10, 2024

2023 turned out to be a fantastic year for our investors. Here is a brief look at some of our strategies that performed well over the past year.

Via Talk Markets · January 1, 2024

The SPDR S&P 500 (NYSE: SPY) was spiking about 0.6% higher Monday despite the President of the Cleveland Fed Loretta Mester issuing a warning that the recent market rally, prompted by heightened hopes of

Via Benzinga · December 18, 2023

The SPDR S&P 500 (NYSE: SPY) popped up about 0.5% higher at one point Friday, despite U.S.

Via Benzinga · December 8, 2023

US stock market saw 'extreme buying' leading to 9% returns since Oct. 31.

Via Benzinga · December 5, 2023