Latest News

As of February 6, 2026, Meta Platforms (NASDAQ: META) stands at a pivotal juncture in its twenty-two-year history. After surviving the "Year of Efficiency" in 2023 and the subsequent AI-driven bull run of 2024, the company is now navigating a complex market environment characterized by a "monetization inflection point." While its core social media empire—the [...]

Via Finterra · February 6, 2026

On February 6, 2026, Under Armour (NYSE: UAA / UA) finds itself at a pivotal crossroads in its thirty-year history. Once the brash upstart that dared to challenge the dominance of industry titans, the Baltimore-based athletic apparel brand has spent the last several years navigating a complex "reset" of its business model. Under the renewed [...]

Via Finterra · February 6, 2026

Date: February 6, 2026 Introduction As we enter 2026, the artificial intelligence landscape has matured from speculative excitement into a race for architectural efficiency. At the center of this transition sits Broadcom Inc. (NASDAQ: AVGO), a company that has evolved from a diversified semiconductor conglomerate into the indispensable "plumbing" of the global AI economy. While [...]

Via Finterra · February 6, 2026

Power's out? Your backup options are getting better — and smarter

(BPT) - Power outages have always been part of life, but today they are lasting longer, happening more frequently and hitting harder in places that once saw little extreme weather.

Via Brandpoint · February 6, 2026

As of February 6, 2026, the global financial landscape is still reverberating from a historic tectonic shift that occurred in the final months of last year. In the fourth quarter of 2025, the M&A market witnessed an unprecedented "mega-deal" frenzy, with 22 global transactions valued at over $10 billion

Via MarketMinute · February 6, 2026

As of February 6, 2026, The Walt Disney Company (NYSE: DIS) stands at one of the most significant inflection points in its 103-year history. After a half-decade of digital transformation, high-stakes leadership drama, and a grueling post-pandemic recovery, the House of Mouse has finally emerged as a leaner, more focused entertainment powerhouse. With the recent [...]

Via Finterra · February 6, 2026

The long-awaited "deal drought" has officially broken. As of early February 2026, the American financial landscape is being reshaped by a massive resurgence in corporate deal-making, punctuated by a staggering 111.5% year-over-year increase in transactions valued over $100 million at the close of 2025. This tidal wave of capital

Via MarketMinute · February 6, 2026

As of February 6, 2026, AstraZeneca PLC (NASDAQ: AZN) stands as a case study in corporate resilience and strategic reinvention. Once a company teetering on the edge of a massive patent cliff a decade ago, the British-Swedish multinational has transformed into a high-growth oncology and rare disease powerhouse. With a market capitalization now rivaling the [...]

Via Finterra · February 6, 2026

Chinese officials have reportedly warned that tokenizing real-world assets and related services could constitute illegal fundraising.

Via Stocktwits · February 6, 2026

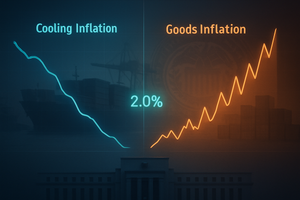

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

Investors should be prepared for a different type of bull market.

Via The Motley Fool · February 6, 2026

As of February 6, 2026, the technology sector is witnessing a historic resurgence in a corner of the market once considered "legacy": data storage. Western Digital Corp. (NASDAQ: WDC) has emerged as the standout performer of the first quarter, with its stock price surging over 28% in the first week of February alone. This rally [...]

Via Finterra · February 6, 2026

Under Armour UAA Q3 2026 Earnings Call Transcript

Via The Motley Fool · February 6, 2026

The specter of a prolonged federal freeze dissipated early this week as President Donald Trump signed a $1.2 trillion spending package into law on February 3, 2026. The move officially ended a four-day partial government shutdown that had paralyzed several federal agencies since the clock struck midnight on January

Via MarketMinute · February 6, 2026

Date: February 6, 2026 Introduction As of early 2026, Tesla (Nasdaq: TSLA) finds itself at the most critical juncture since the 2018 "Model 3 production hell." No longer just a high-growth electric vehicle manufacturer, Tesla is aggressively rebranding itself as a "Physical AI" and robotics powerhouse. This transition comes at a time when its core [...]

Via Finterra · February 6, 2026

As the final reports from the 2025 year-end earnings season filter through Wall Street, the "Magnificent 7" have once again demonstrated their dominance, but with a critical new caveat. The early February 2026 results reveal a group of companies that are no longer just building the "digital railroads" of Artificial

Via MarketMinute · February 6, 2026

It's a change that could affect many, many enrollees.

Via The Motley Fool · February 6, 2026

Unum Group (UNM) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 6, 2026

Date: February 6, 2026Sector: Semiconductors / Artificial IntelligenceTicker: NVIDIA (Nasdaq: NVDA) Introduction As we navigate the first quarter of 2026, the global technology landscape is defined by one central gravity well: NVIDIA (Nasdaq: NVDA). While the "AI mania" of 2023 and 2024 has matured into a more disciplined "AI rationalization" era, NVIDIA has emerged not [...]

Via Finterra · February 6, 2026

The global financial landscape has been sent into a whirlwind of speculation and strategic repricing following President Trump’s formal nomination of Kevin Warsh to succeed Jerome Powell as the next Chair of the Federal Reserve. Announced on January 30, 2026, the move marks a pivotal transition for the world’

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is characterized by a "new normal" of elevated volatility and a pervasive "options-ification" of retail and institutional portfolios. Standing at the epicenter of this transformation is Cboe Global Markets, Inc. (CBOE: CBOE), an exchange operator that has evolved from a niche Chicago-based floor for options into [...]

Via Finterra · February 6, 2026

AerCap (AER) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 6, 2026

Agricultural markets are entering a period of profound uncertainty as a confluence of surging input costs, volatile weather patterns, and shifting geopolitical alliances threaten to destabilize global food security. Despite a period of relative stabilization throughout 2025, early data from February 2026 suggests the "calm" is rapidly evaporating. According to

Via MarketMinute · February 6, 2026

The Federal Reserve Open Market Committee (FOMC) concluded its first policy meeting of 2026 on January 28, voting to maintain the federal funds rate at a target range of 3.5% to 3.75%. This widely anticipated decision marks a pivotal shift in the central bank’s strategy, moving from

Via MarketMinute · February 6, 2026

As of February 6, 2026, Biogen Inc. (NASDAQ: BIIB) stands at a critical crossroads in its nearly 50-year history. Once the undisputed titan of the Multiple Sclerosis (MS) market, the Cambridge-based biotechnology pioneer is now navigating an aggressive and complex transition. Under the leadership of CEO Christopher Viehbacher, Biogen has spent the last two years [...]

Via Finterra · February 6, 2026

The Great Commodity Divergence: Broad Funds Rally While Precious Metals Face 'Breathtaking' Volatility

As investors navigate the opening weeks of 2026, the commodity markets have transformed into a tale of two realities. While broad-based commodity vehicles like the WisdomTree Commodity Index Fund (NYSE Arca: GCC) have surged a remarkable 10.

Via MarketMinute · February 6, 2026

The fourth-quarter earnings season of 2025 has reached a fever pitch, delivering a resounding message of resilience to Wall Street. As of February 6, 2026, the S&P 500 has reported an aggregate year-over-year earnings growth of 10.1%, a figure that has silenced skeptics who feared a late-cycle slowdown.

Via MarketMinute · February 6, 2026

Date: February 6, 2026 Introduction In the volatile world of global luxury, few brands have navigated the shifting tides of consumer sentiment as masterfully as Ralph Lauren (NYSE: RL). As of early 2026, the company stands as a testament to the enduring power of brand heritage combined with modern operational discipline. While many of its [...]

Via Finterra · February 6, 2026

The global economic landscape is facing a profound shift as the World Bank’s latest "Commodity Markets Outlook," released in early February 2026, forecasts that commodity prices will plummet to their lowest levels in six years. This decline marks the fourth consecutive year of retreating prices, signaling the definitive end

Via MarketMinute · February 6, 2026

Perella Weinberg (PWP) Q4 2025 Earnings Transcript

Via The Motley Fool · February 6, 2026

As of February 6, 2026, Roivant Sciences (Nasdaq: ROIV) has firmly established itself as the preeminent "capital allocator" of the biotechnology sector. The company made headlines today with a significant 15% stock surge, a move driven by clinical validation of its diversified "Vant" model. This recent rally—pushing shares toward a yearly high of $24.21—is primarily [...]

Via Finterra · February 6, 2026

Gold rebounds as weak U.S. labor data and growing Fed rate cut bets lift sentiment.

Via Talk Markets · February 6, 2026

The U.S. energy market was rocked in January 2026 as natural gas prices skyrocketed by a staggering 78.4%, catapulting from a December average of $4.25 per million BTU to a peak average of $7.58. This historic surge, detailed in the latest World Bank Commodity Markets report,

Via MarketMinute · February 6, 2026

Roivant Sciences unveiled "exceptional" results Friday for its skin disease treatment, sending the biotech stock flying.

Via Investor's Business Daily · February 6, 2026

As of February 6, 2026, Philip Morris International (NYSE: PM) stands at a historic crossroads. Long regarded as the quintessential "Big Tobacco" play, the company has spent the last decade aggressively cannibalizing its own legacy combustible business to lead a global "smoke-free" revolution. Today, the results of this gamble are no longer speculative; they are [...]

Via Finterra · February 6, 2026

As of February 6, 2026, the agricultural sector finds itself at the center of a high-stakes tug-of-war between digital diplomacy and physical market fundamentals. This week, the soybean market transformed into a volatile arena where a single social media post from President Donald Trump managed to erase weeks of bearish

Via MarketMinute · February 6, 2026

AI stocks continue to drop, but are any offering opportunities for long-term investors?

Via The Motley Fool · February 6, 2026

Date: February 6, 2026 Introduction In the opening weeks of 2026, the technology sector has found itself at a crossroads, with Microsoft Corporation (NASDAQ: MSFT) serving as the primary bellwether for the "AI Era." Long considered the gold standard of the cloud transition, Microsoft has recently seen its stock retreat by approximately 5%, a move [...]

Via Finterra · February 6, 2026

The global energy market has been jarred by a "violent reversal" in crude oil prices during the first week of February 2026. After a blistering 14% rally in January that saw West Texas Intermediate (WTI) surge to multi-month highs near $67 per barrel, the benchmark has slid approximately 6% in

Via MarketMinute · February 6, 2026

Date: February 6, 2026 Introduction In the first week of February 2026, the financial markets witnessed a stark reminder of the volatility inherent in the "Bitcoin Treasury" model. MicroStrategy (NASDAQ: MSTR), which recently rebranded its corporate identity to reflect its status as a "Bitcoin Development Company," saw its stock price crater by 17% in a [...]

Via Finterra · February 6, 2026

As the global energy sector faces a softening crude market in early 2026, BP (LSE: BP) has emerged as an unexpected outlier. Despite a broader slump in oil prices—with Brent crude hovering in the mid-$60s amid a global supply surplus—shares of the London-based major have climbed 4.

Via MarketMinute · February 6, 2026

Today’s Date: February 6, 2026 Introduction On February 5, 2026, the global semiconductor market witnessed a decisive vote of confidence in the future of silicon architecture. Arm Holdings (NASDAQ: ARM) saw its share price surge by 6% in a single trading session following the release of its third-quarter fiscal 2026 earnings. The rally underscored a [...]

Via Finterra · February 6, 2026

LONDON — Shell, the British energy giant, reported its weakest quarterly profit in nearly five years on February 5, 2026, as a combination of cooling global oil prices and a protracted downturn in the chemicals market finally caught up with the company’s bottom line. The London-based major posted adjusted earnings

Via MarketMinute · February 6, 2026

This New England banking firm reported notable insider selling as it maintains steady dividends and a diversified revenue base.

Via The Motley Fool · February 6, 2026

On February 6, 2026, the global consumer staples market is buzzing with a singular name: The Hershey Company (NYSE: HSY). Following its fiscal results reported yesterday, the legendary chocolatier saw its stock price surge by over 9%, marking its most significant single-day gain in years. For a company often viewed as a "slow and steady" [...]

Via Finterra · February 6, 2026

In an extraordinary display of market volatility that has blindsided global economists, the silver market has just concluded a historic monthly rally, posting a staggering gain of approximately 65%. This meteoric rise, which saw the metal breach the triple-digit barrier to hit an intraday high of $121.67 per ounce,

Via MarketMinute · February 6, 2026

The S&P 500 is now down in 2026, and two of the eleven sectors are up by double digits.

Via Talk Markets · February 6, 2026

The global financial landscape underwent a seismic shift in the first week of February 2026, as the nomination of Kevin Warsh to succeed Jerome Powell as Chairman of the Federal Reserve sent shockwaves through the commodities and currency markets. The announcement, made by the White House on January 30 and

Via MarketMinute · February 6, 2026

Today’s Date: February 6, 2026 Introduction In the high-stakes world of global fashion, momentum is the most valuable currency. On February 5, 2026, Tapestry, Inc. (NYSE: TPR) proved it possesses that momentum in spades. Following the release of its Fiscal Second Quarter 2026 results, shares of the New York-based house of brands surged by more [...]

Via Finterra · February 6, 2026

The commodities super-cycle of the mid-2020s hit a violent, brick wall this week in what traders are already calling the "Warsh Meltdown." After a multi-year rally that saw gold reach stratospheric heights, the market experienced a historic systemic liquidity rupture. Gold prices, which peaked at a staggering $5,594 per

Via MarketMinute · February 6, 2026