Latest News

Via MarketBeat · February 6, 2026

As of early February 2026, the long-predicted "Great Rotation" in the financial markets has moved from a theoretical forecast to a dominant reality. After years of a top-heavy market driven by a handful of technology titans, the tide has finally turned. The first five weeks of 2026 have seen the

Via MarketMinute · February 6, 2026

As of early February 2026, the global financial markets are witnessing a paradigm shift that many analysts are calling the "Security Supercycle." What began as a reactive surge in defense spending following the 2022 invasion of Ukraine has evolved into a structural, multi-decade rearmament phase. This "deterrence economy" has pushed

Via MarketMinute · February 6, 2026

Fed’s Mary Daly Comments On Economic Outlook, Says Americans Deserve Price Stability And Full Employmentstocktwits.com

Via Stocktwits · February 6, 2026

As of February 6, 2026, the corporate landscape in London is being redefined not by ambitious mergers or technological breakthroughs, but by a massive, sustained return of capital to shareholders. Yesterday’s twin announcements from Shell (LSE: SHEL) and Vodafone (LSE: VOD)—confirming billions in fresh share buybacks—mark a

Via MarketMinute · February 6, 2026

In a staggering reversal that has stunned global commodity markets, gold prices have retreated sharply from their historic record highs, recording a massive 11% correction over the past week. The sell-off, which culminated in a violent "flash crash" on January 30, 2026, saw spot gold tumble from a peak of

Via MarketMinute · February 6, 2026

The share price has grown exponentially since 1969, but Walmart paid a high price for one mistake.

Via The Motley Fool · February 6, 2026

Doximity's stock is sinking on conservative guidance, but its long-term investment thesis remains intact.

Via The Motley Fool · February 6, 2026

The paradox of the "front page of the internet" was on full display this week as Reddit, Inc. (NYSE: RDDT) reported fourth-quarter 2025 financial results that, on paper, should have sent shares soaring. The company delivered a significant beat on both top and bottom lines, fueled by a surge in

Via MarketMinute · February 6, 2026

Investors are shifting into names outside of tech that could have room to run.

Via The Motley Fool · February 6, 2026

As the dust settles on the 2025 holiday shopping season, Apple Inc. (NASDAQ:AAPL) has once again silenced skeptics with a blockbuster fiscal first-quarter report that underscores the company’s unparalleled market resilience. Defying fears of a saturated global smartphone market and geopolitical headwinds, the tech giant posted record-breaking revenue

Via MarketMinute · February 6, 2026

Cincinnati Financial Corp. is an insurance holding company that primarily markets property and casualty coverage. It also conducts life insurance and asset management operations.

Via Talk Markets · February 6, 2026

Uber Technologies (NYSE: UBER) reported its fourth-quarter and full-year 2025 earnings this week, unveiling a financial performance that underscores its absolute dominance in the global mobility and delivery sectors. While the company achieved record-breaking revenue and user growth, the market’s reaction remained lukewarm, as investors balanced impressive operational metrics

Via MarketMinute · February 6, 2026

In late January 2026, the artificial intelligence gold rush hit a structural wall of skepticism. Microsoft (Nasdaq: MSFT), the company that kicked off the generative AI era with its investment in OpenAI, reported a set of quarterly earnings that has left Wall Street divided. While the tech giant posted record

Via MarketMinute · February 6, 2026

GE Vernova's growth cycle is only getting started.

Via The Motley Fool · February 6, 2026

Shares of aerospace and defense company Huntington Ingalls (NYSE:HII)

jumped 5.2% in the morning session after the company reported strong fourth-quarter results that surpassed Wall Street's expectations for both revenue and profit, driven by operational improvements and a positive outlook for 2026.

Via StockStory · February 6, 2026

Shares of global satellite communications provider Viasat (NASDAQ:VSAT) jumped 7.4% in the morning session after the company reported fourth-quarter results that showed a significant earnings beat, even as revenue came in slightly below forecasts.

Via StockStory · February 6, 2026

Shares of global life reinsurance provider Reinsurance Group of America (NYSE:RGA) jumped 7.4% in the morning session after the company reported fourth-quarter 2025 financial results that significantly surpassed Wall Street's expectations.

Via StockStory · February 6, 2026

Shares of financial services company Robinhood (NASDAQ:HOOD)

jumped 14.9% in the morning session after a rebound in cryptocurrency prices lifted related stocks.

Via StockStory · February 6, 2026

Shares of global music entertainment company Warner Music Group (NASDAQ:WMG) jumped 5.8% in the morning session after the company reported fourth-quarter 2025 earnings that showed strong revenue and profit growth, which overshadowed a miss on earnings per share. Investors focused on the positive aspects of the report, even though earnings of $0.33 per share did not meet forecasts. The company posted revenue of $1.84 billion, which beat analyst expectations and represented a 10.4% increase from the previous year. Furthermore, Warner Music showed improved profitability. A key measure, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), came in at $463 million, beating analyst estimates, while its operating margin expanded to 15.7% from 12.8% in the same quarter last year.

Via StockStory · February 6, 2026

Shares of cybersecurity platform provider CrowdStrike (NASDAQ:CRWD) jumped 3% in the morning session after momentum in the SaaS segment improved, supported by reports that the company entered into a Memorandum of Understanding (MoU) with Aramco to advance Saudi Arabia's cybersecurity transformation.

Via StockStory · February 6, 2026

Shares of bearings manufacturer RBC Bearings (NYSE:RBC) jumped 4.6% in the morning session after the company reported strong fiscal third-quarter results that surpassed analyst expectations and provided an optimistic outlook for the upcoming quarter.

Via StockStory · February 6, 2026

Shares of satellite radio and media company Sirius XM (NASDAQ:SIRI)

fell 4.2% in the morning session after Seaport Global Securities downgraded the stock to Neutral from Buy, citing the company's guidance for 2026.

Via StockStory · February 6, 2026

Shares of investment banking firm Piper Sandler (NYSE:PIPR) jumped 8.5% in the morning session after the company reported strong fourth-quarter 2025 results that significantly surpassed Wall Street's expectations for both revenue and earnings.

Via StockStory · February 6, 2026

Shares of health care services provider Encompass Health (NYSE:EHC)

jumped 11.9% in the morning session after the company reported strong fourth-quarter earnings and raised its profit forecast for the full year 2026.

Via StockStory · February 6, 2026

Shares of RFID manufacturer Impinj (NASDAQ:PI) fell 22.1% in the morning session after the company issued a weak financial outlook for the first quarter of 2026 and received an analyst downgrade.

Via StockStory · February 6, 2026

Shares of dental products company Envista Holdings (NYSE:NVST)

jumped 13.5% in the morning session after the company reported fourth-quarter financial results that significantly beat Wall Street's expectations for both revenue and earnings.

Via StockStory · February 6, 2026

Shares of semiconductor equipment provider Amtech Systems (NASDAQ: ASYS) plunged after the company reported mixed results for the fourth quarter of 2025, where a significant earnings miss overshadowed revenue that was in line with expectations.

Via StockStory · February 6, 2026

Shares of blockchain infrastructure company Coinbase (NASDAQ:COIN) jumped 9.5% in the morning session after the price of Bitcoin rebounded from a significant drop, sparking a relief rally across crypto-related stocks.

Via StockStory · February 6, 2026

Shares of packaged foods company Post (NYSE:POST)

jumped 9.5% in the morning session after the company reported strong fourth-quarter 2025 results that surpassed analyst expectations and raised its full-year financial outlook.

Via StockStory · February 6, 2026

In a dramatic shift for global equity markets, the first week of February 2026 has witnessed a sharp technical breakdown as long-standing momentum gauges for the S&P 500 (NYSE:SPY) turned negative. The bullish fervor that propelled the market to historic highs throughout 2025 has collided with a wall

Via MarketMinute · February 6, 2026

The global mergers and acquisitions (M&A) landscape has officially shifted from a period of high-rate hibernation to an era of "megadeal" dominance. On February 4, 2026, Evercore (NYSE:EVR) reported record-breaking fourth-quarter earnings that not only shattered analyst expectations but also served as a definitive bellwether for a broader

Via MarketMinute · February 6, 2026

Baird lowered its price target on Reddit to $200 from $240, and maintained a ‘Neutral’ rating on the shares, saying it updated its model after its quarterly results and outlook.

Via Stocktwits · February 6, 2026

The four-day partial government shutdown that began at midnight on January 30, 2026, has officially come to a close, yet the ripples of the gridlock continue to disturb the waters of Wall Street. While the signing of a short-term funding bill on February 3 restored operations for the Department of

Via MarketMinute · February 6, 2026

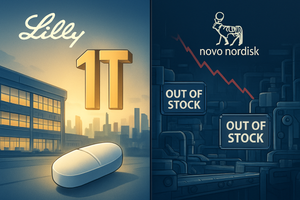

The drugmaker is facing pricing pressures on its weight loss medications.

Via The Motley Fool · February 6, 2026

Packaged foods company Post (NYSE:POST) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 10.1% year on year to $2.17 billion. Its non-GAAP profit of $2.13 per share was 27.7% above analysts’ consensus estimates.

Via StockStory · February 6, 2026

In the world of retail finance, the "meme stock" era has officially been replaced by the "event contract" era. Leading this charge is Robinhood (NASDAQ: HOOD), which has successfully pivoted its massive user base from speculative equity trading toward the rapidly expanding frontier of prediction markets. As of early February 2026, the platform has moved [...]

Via PredictStreet · February 6, 2026

Many people use the S&P 500 for the core of their portfolios. I think broad market ETFs are a better choice. Here's the one I own in my portfolio.

Via The Motley Fool · February 6, 2026

WASHINGTON, D.C. — In a week that has sent tremors through the global financial architecture, Treasury Secretary Scott Bessent appeared before the Senate Banking Committee on February 5, 2026, delivering testimony that many economists believe signals a fundamental shift in the relationship between the White House and the Federal Reserve.

Via MarketMinute · February 6, 2026

The gaming company reported a loss of $0.45 per share in Q4 on revenue of $2.22 billion, compared to Wall Street estimates of a loss of $0.47 per share on revenue of $1.79 billion.

Via Stocktwits · February 6, 2026

The landscape of global finance shifted permanently this winter as the Intercontinental Exchange (NYSE: ICE) finalized a staggering $2 billion strategic investment into Polymarket. For years, prediction markets were viewed as the "Wild West" of decentralized finance—a niche playground for crypto-natives and political junkies. However, with the backing of the world’s most powerful exchange operator, [...]

Via PredictStreet · February 6, 2026

The nomination of Kevin Warsh to lead the Federal Reserve has ignited a firestorm in Washington, pitting the White House against a group of determined Republican senators and paralyzing the world’s most powerful central bank. As of February 6, 2026, the transition of power at the Fed—intended by

Via MarketMinute · February 6, 2026

As of February 6, 2026, the traditional landscape of geopolitical analysis is undergoing a radical transformation. While cable news pundits and academic experts grapple with the nuances of diplomatic cables and legislative posturing, a more precise—and often more brutal—barometer has emerged: the prediction market. In the first week of February, these markets have become the [...]

Via PredictStreet · February 6, 2026

Johnson Outdoors (JOUT) Earnings Call Transcript

Via The Motley Fool · February 6, 2026

The global race for obesity market dominance reached a historic turning point this week as Eli Lilly and Company (NYSE: LLY) officially crossed the $1 trillion market capitalization threshold, cementing its status as the world’s most valuable healthcare entity. The milestone follows a stellar 2026 guidance report that projected

Via MarketMinute · February 6, 2026

As of February 6, 2026, the digital landscape has undergone a tectonic shift. Once relegated to the fringes of the internet and dismissed as "speculative casinos," prediction markets have officially entered the mainstream. This transformation is crystallized by the recent, sweeping policy updates from Alphabet (NASDAQ: GOOGL) and Meta (NASDAQ: META), which have moved to [...]

Via PredictStreet · February 6, 2026

Via MarketBeat · February 6, 2026

As the dust settles on the fourth-quarter earnings season of 2025, a clear divergence has emerged among the "Magnificent Seven" technology giants. While much of Silicon Valley is grappling with the staggering costs of the artificial intelligence arms race, Meta Platforms Inc. (NASDAQ: META) has defied the skeptics. By successfully

Via MarketMinute · February 6, 2026

As of February 6, 2026, the intersection of high finance and political power has reached a new frontier. The Trump family, led by Donald Trump Jr., has successfully pivoted from the political arena into the bedrock of the global "Information Finance" (InfoFi) movement. With strategic advisory roles at the industry’s two largest platforms, Kalshi and [...]

Via PredictStreet · February 6, 2026

The financial world was sent into a tailspin this week as a massive market rout wiped out approximately $285 billion in market capitalization across the software, financial services, and asset management sectors. The catalyst for the sell-off, which analysts are calling the "SaaSpocalypse," was the release of a suite of

Via MarketMinute · February 6, 2026