Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

The January ISM Manufacturing report signals a strong shift toward expansion, with the headline index hitting a multi-year high of 52.6.

Via Talk Markets · February 2, 2026

The markets have been rocked by news of a possible intervention to control the Japanese yen slump, after it reached a forty-year low relative to the US dollar.

Via Talk Markets · February 2, 2026

Weeks ago, I speculated that Bitcoin would soon fall to “75,000-ish“. Well, I was awfully close! The low from trading last night matched with literally 99.99% accuracy the Liberation Low from back in April.

Via Talk Markets · February 2, 2026

Although the benchmark indices opened lower, they traded negatively throughout the session and ultimately closed red.

Via Talk Markets · February 2, 2026

The stock market was jolted on Friday following a Wall Street Journal report that Nvidia was reconsidering its massive $100 billion investment in OpenAI.

Via Talk Markets · February 2, 2026

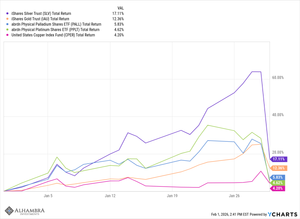

The top news at the start of the week is the ongoing meltdown in the metals market.

Via Talk Markets · February 2, 2026

The Pound Sterling trades higher against its major currency peers.

Via Talk Markets · February 2, 2026

The debasement/decline in the value of the U.S. dollar pushes investors into precious metals, including silver.

Via Talk Markets · February 2, 2026

Gold price analysis suggests the probability of further downside as the stronger dollar weighs on the precious metal.

Via Talk Markets · February 2, 2026

The S&P 500 had a remarkably subdued week compared to other markets.

Via Talk Markets · February 2, 2026

The COT currency market speculator bets were overall decisively higher this week as ten out of the eleven currency markets we cover had higher positioning while the other one markets had lower speculator contracts.

Via Talk Markets · February 2, 2026

Gold fell over 10% last Friday, and that was the good news from the metals.

Via Talk Markets · February 2, 2026

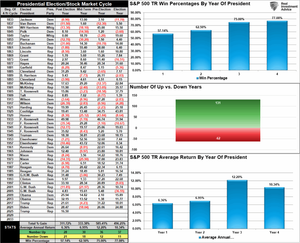

Market cycles are once again at the center of the investment narrative as we head into 2026.

Via Talk Markets · February 2, 2026

Gold and silver extended their sell-off from last week, with prices diving another $400.

Via Talk Markets · February 2, 2026

Gold’s January surge was extraordinary — its best start to a year since 1980.

Via Talk Markets · February 2, 2026

A breakout failure, hawkish Warsh surprise, weak seasonality, and High Trend Fragility suggest odds favor a sentiment washout is on the table.

Via Talk Markets · February 2, 2026

The Pound Sterling trades higher against its major currency peers.

Via Talk Markets · February 2, 2026

UK hiring conditions are weak, and pay growth is slowing rapidly.

Via Talk Markets · February 2, 2026

The Fed is not in a good spot.

Via Talk Markets · February 2, 2026

The price action seen over the course of the past 3 trading days has been nothing short of historic, with the nomination of Kevin Warsh as the next Fed chair sending shockwaves throughout markets.

Via Talk Markets · February 2, 2026

Disney exceeded Q1 expectations with adjusted EPS of $1.63 and revenue of $25.98 billion, driven by strength in its entertainment business.

Via Talk Markets · February 2, 2026

In the Philippine flood-control corruption scandal, the multibillion-dollar net losses are huge. But without adequate resolution, international pressures could multiply the damage.

Via Talk Markets · February 2, 2026

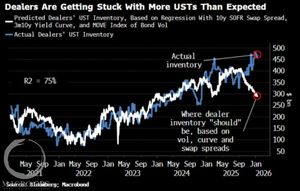

A key corner of the credit market is experiencing sustained and even accelerated selling at the end of January 2026

Via Talk Markets · February 2, 2026

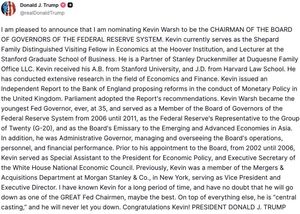

The wait is over, and President Trump has nominated Kevin Warsh to head the Federal Reserve.

Via Talk Markets · February 2, 2026

Asian markets traded mixed on Monday ahead of China's factory activity data.

Via Talk Markets · February 2, 2026

USDJPY rose to 154.98 on Monday, with the yen continuing to fall. Pressure on the currency increased after statements by Japanese Prime Minister Sanae Takaichi.

Via Talk Markets · February 2, 2026

The AUD/USD forecast edges to the downside despite a hotter inflation print as the yields fell sharply, suggesting only a single RBA hike in the near term.

Via Talk Markets · February 2, 2026

Market pressure was driven by rising Treasury yields and a strengthening dollar after President Donald Trump appointed Kevin Warsh as the successor to Fed Chair Jerome Powell.

Via Talk Markets · February 2, 2026

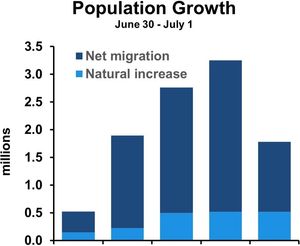

New Census data confirms slower population growth ahead. Business leaders must prepare for lower GDP growth, zero net migration, and shortages of low-skilled labor.

Via Talk Markets · February 2, 2026

Over the weekend, President Trump suggested that a workable deal with Iran could happen. That reduced fears of war, which had been pushing market prices higher.

Via Talk Markets · February 2, 2026

Intervention, no doubt, is very tempting for control freak central planners. Yet they would be wise to resist.

Via Talk Markets · February 2, 2026

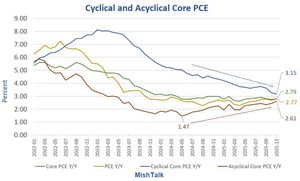

How inflation has changed over the past 10 years

Via Talk Markets · February 1, 2026

As measured by the equities market, last week was kind of exciting.

Via Talk Markets · February 1, 2026

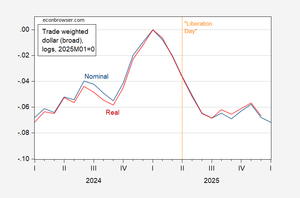

Most empirical work on the previous trade war, and the ongoing, suggests tariff pass through for the United States is near 100%.

Via Talk Markets · February 1, 2026

Friday's dramatic market turnaround sent shockwaves through assets that had been thriving in January, triggering a sharp sell-off.

Via Talk Markets · February 2, 2026

The AUD/USD exchange rate retreated after Donald Trump ended the speculation about the next Federal Reserve Chairman.

Via Talk Markets · February 2, 2026

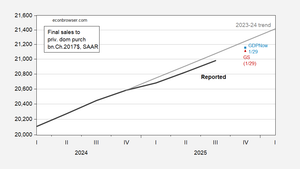

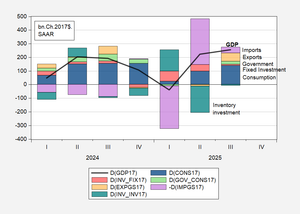

From Atlanta Fed and Goldman Sachs, numbers that perhaps better represent the trajectory of aggregate demand.

Via Talk Markets · February 2, 2026

Global markets are consolidating after sharp recent moves, with FX seeing an orderly pullback that still looks more like profit-taking than a true reversal.

Via Talk Markets · February 2, 2026

The dollar has recovered a bit further as gold and silver have plunged, and we think there is enough stability to let data do the talking in FX this week.

Via Talk Markets · February 2, 2026

Bitcoin looks as if it is struggling to hold itself above major support. Ultimately, this is a market that is ready to make a bigger move.

Via Talk Markets · February 2, 2026

Expectations for economic data releases coming up in the first half of February.

Via Talk Markets · February 1, 2026

Stocks have been stuck in a compressing trading range for the past several months.

Via Talk Markets · January 31, 2026

An illustrated guide to things that should make you uneasy.

Via Talk Markets · January 31, 2026

The Canadian dollar continues to dominate its neighbour after the pair fell by more than 200 pips in recent sessions.

Via Talk Markets · February 2, 2026

Japanese PM Sanae Takaichi said a weak JPY supports exports and helps cushion the auto sector from US tariffs.

Via Talk Markets · February 2, 2026

Palantir stock reports Q4 2025 earnings Monday. Analysts expect 62% revenue growth to $1.34B. Wall Street remains divided on outlook.

Via Talk Markets · February 2, 2026

If we lack amazement, we cannot tap into inspiration. The narrowness of our perspective prevents us from broadening our horizons.

Via Talk Markets · February 1, 2026

No one will understand everything well enough to invest, just avoid the ones you don't understand.

Via Talk Markets · February 1, 2026

China gets most Oil from Iran so they do have an indirect degree of leverage against the United States you don't hear of generally... because they were accumulating Treasuries during far calmer times and distributing 'some' more recently.

Via Talk Markets · February 1, 2026

We discuss why the modern discussion of the division of labor is distorted by bad theory and political incentives.

Via Talk Markets · January 31, 2026

Tom Lee, ubiquitous chairman of Bitmine Immersion Technologies (BMNR), has been buying a lot of Ethereum. And lately he's lost $6 billion on it.

Via Talk Markets · February 1, 2026

On Friday – the day Warsh’s nomination was announced – the dollar, up 0.9 percent, and precious metals gold and silver, down 9.1 percent and 26.9 percent respectively, seemed to be pricing out concerns about Fed independence.

Via Talk Markets · February 1, 2026

President Trump announced that he will nominate Kevin Warsh to serve as the next chair of the Federal Reserve. The dollar gained 0.8% following the news. Stocks closed lower, with the Nasdaq down roughly 1% and the S&P 500 losing around 0.4%.

Via Talk Markets · February 1, 2026

While spot silver ETFs remain the simplest method to gain exposure to the metal, aggressive investors often turn to mining ETFs for embedded leverage. Here’s what to know about the Global X Silver Miners ETF and the Amplify Junior Silver Miners ETF.

Via Talk Markets · February 1, 2026

In this video, I provide a weekly update on the Nasdaq 100. I also discuss recent market challenges and earnings reports from major tech companies.

Via Talk Markets · February 1, 2026

The price action in metals on Friday was one for the record books. Silver plunged by more than 26% and was down over 30% intraday. Gold was not much better. The metal often described as a safe haven or store of value fell by roughly 9%.

Via Talk Markets · February 1, 2026

Chevron Corp announced a 4.0% dividend per share hike to $7.12 annually on Jan. 30, slightly lower than my expectation of a 5% hike to $7.18. Chevron stock has risen 20% since mid-December. It could be fully valued, as it has reached my price target.

Via Talk Markets · February 1, 2026

Markets are volatile, valuations are shifting, and wide-moat companies are back in focus. In this video, we discuss our top stock picks.

Via Talk Markets · February 1, 2026

The cryptocurrency market appears to be crashing as we speak, with major losses seen across the board. Cryptocurrency had been on a downtrend since early December. On the last day of January, the situation worsened dramatically.

Via Talk Markets · February 1, 2026

In spite of the strong market return, consumer sentiment remains at a low level, maybe due to the fact not all consumers enjoy the direct benefit of a rising stock market. However, when sentiment is lower, stock market returns tend to be strong.

Via Talk Markets · February 1, 2026

Silver is down 30%. Gold is down 10%. Bitcoin has dropped nearly 20% in days. We are witnessing a historic

Via Talk Markets · February 1, 2026

The SPX has been unable to make much progress into higher price levels for a couple of months. It seems ready for a price consolidation, which means it is likely time to be a bit cautious towards stock prices in the longer-term.

Via Talk Markets · February 1, 2026

The slowing of the economy (as measured by domestic final sales) and the increase in the contemporaneous tariff rate have roughly equal coefficients.

Via Talk Markets · January 31, 2026

There has been much discussion, both here and around the world, of the possibility of a flight from the dollar. This has always been a serious risk since Donald Trump took office.

Via Talk Markets · January 31, 2026

Verizon issued strong Q4 results and strong guidance for 2026. We continue to recommend investment in the telecom giant for income.

Via Talk Markets · January 31, 2026

For years, equity markets have leaned on the “Fed Put” – the belief that the central bank would reliably inject liquidity at the first sign of trouble. Warsh, however, is a vocal critic of the Fed’s tendency to “pamper” markets.

Via Talk Markets · January 31, 2026

2026 will be a bullish year, but not as rich as last one or the one before.

Via Talk Markets · January 31, 2026

With one exception, the trends in December continued in January. Headline business conditions continued to indicate contraction, but at a decelerating rate.

Via Talk Markets · January 31, 2026

The move underscores Beijing’s growing recognition that traditional stimulus tools are proving less effective in lifting consumer spending.

Via Talk Markets · January 31, 2026

Over the past year, Cenovus Energy has rallied 40.9%, significantly outperforming Enbridge’s 13.9% gain. But does stronger price performance automatically make Cenovus the better stock? Here's a look at the fundamentals of both companies to find out.

Via Talk Markets · January 31, 2026

The excitement over providing retail access to private equity seems to have turned sour with more skepticism. As the aforementioned excitement built, we talked frequently about not getting wrapped up with illiquid vehicles offering private equity.

Via Talk Markets · January 31, 2026

This past week, I raised my cash percentage to the highest level since last year's correction. I'm not ready to start pulling the trigger on short positions. But the market's conditions are becoming a lot frothier.

Via Talk Markets · January 31, 2026

I previously discussed companies that own land and water rights, which will be important to data center build-outs. But it all starts with energy. Without energy, data centers don’t run. The electricity generator to take note of is Black Hills.

Via Talk Markets · January 31, 2026

Hey, remember quantum computing? That was a sector that was getting a tremendous amount of hype, in spite of no products, no revenues, and certainly no profits. It’s heartening to see sanity return to the world, as these stocks get blown to pieces.

Via Talk Markets · January 31, 2026

Liquidity continues to be drained from the system, primarily through Treasury issuance and rising TGA balances, putting pressure on risk assets.

Via Talk Markets · January 31, 2026