Advanced Micro Devices, Inc. - Common Stock (AMD)

246.27

+0.00 (0.00%)

NASDAQ · Last Trade: Feb 3rd, 9:14 AM EST

Detailed Quote

| Previous Close | 246.27 |

|---|---|

| Open | - |

| Bid | 250.80 |

| Ask | 251.00 |

| Day's Range | N/A - N/A |

| 52 Week Range | 76.48 - 267.08 |

| Volume | 799,093 |

| Market Cap | 298.72B |

| PE Ratio (TTM) | 121.92 |

| EPS (TTM) | 2.0 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 37,880,977 |

Chart

About Advanced Micro Devices, Inc. - Common Stock (AMD)

Advanced Micro Devices is a leading global semiconductor company that designs and manufactures computing and graphics solutions for a wide range of applications. The company is known for its innovative microprocessors, graphics cards, and system-on-chip products, which are used in personal computers, servers, and embedded systems. AMD focuses on high-performance computing, gaming, and data center markets, offering advanced technologies that compete with those of other major players in the industry. By delivering cutting-edge products that push the boundaries of processing power and efficiency, AMD plays a critical role in driving technological advancements and enhancing user experiences across various platforms. Read More

News & Press Releases

Advanced Micro Devices needs to address numerous questions about potential delays to its upcoming AI chip.

Via The Motley Fool · February 3, 2026

Although Broadcom and Advanced Micro Devices are formidable threats to the world's largest publicly traded company, its top concern comes from within.

Via The Motley Fool · February 3, 2026

Cantor's Semiconductor analyst C.J. Muse evaluates the outlook for the top chip stocks, Advanced Micro Devices (NASDAQ: AMD), Qualcomm (NASDAQ: QCOM), and Microchip Technology (NASDAQ: MCHP) ahead of their results this week.

Via Benzinga · February 3, 2026

HELSINKI, FINLAND - February 3, 2026 - For decades, enterprise sales has followed a costly, linear rule: to grow revenue, you must hire more salespeople. Today, Optivian declares that era over with the launch of its AI Sales Execution platform, designed to deploy digital workers that autonomously drive complex B2B deals.

Via AB Newswire · February 3, 2026

U.S. stock futures up, Pfizer, Teradyne, Merck & Co., Palantir, and AMD expected to release earnings reports. Palantir and AMD beat estimates.

Via Benzinga · February 3, 2026

AMD’s stock soared +15% in early 2026, gaining over +100% annually as an AI chip rival to Nvidia. Driven by accelerator demand and server share, all eyes are on Q4 results tonight, Feb 3, to see if the buy/hold/profit rally persists.

Via Talk Markets · February 3, 2026

The tech stock is a buy ahead of its upcoming earnings report, according to one Wall Street analyst.

Via The Motley Fool · February 2, 2026

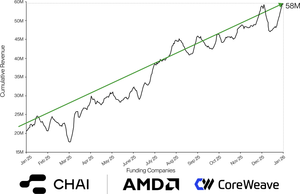

In a landmark year for the generative AI sector, CHAI has officially solidified its position as the world’s leading Social AI platform. The company announced

Via PRUnderground · February 2, 2026

Nvidia actually has a solid case to double in 2026.

Via The Motley Fool · February 2, 2026

Rambus (RMBS) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 2, 2026

Today, Feb. 2, 2026, volatility continues in commodities while manufacturing data boosts markets.

Via The Motley Fool · February 2, 2026

Microsoft fell after reporting earnings despite record results.

Via The Motley Fool · February 2, 2026

As of February 2, 2026, the meteoric rise of the semiconductor sector is facing its most rigorous stress test yet. After a historic 2025 that saw valuations double for many industry leaders, the technical chart for Micron Technology, Inc. (NASDAQ:MU) has begun flashing a series of "ominous signals" that

Via MarketMinute · February 2, 2026

Shares of server solutions provider Super Micro (NASDAQ:SMCI) jumped 2.5% in the afternoon session after Rosenblatt analyst Kevin Cassidy reaffirmed a 'Buy' rating on the company, maintaining the price target at $55.00.

Via StockStory · February 2, 2026

Sometimes it is worth waiting to get extra information rather than chasing a stock.

Via The Motley Fool · February 2, 2026

The artificial intelligence landscape has shifted its gaze from the abstract realm of text to the physical reality of the three-dimensional world. World Labs, the high-profile startup founded by AI pioneer Fei-Fei Li, has officially emerged as the frontrunner in the race for "Spatial Intelligence." Following a massive $230 million funding round led by heavyweight [...]

Via TokenRing AI · February 2, 2026

Looking back from today, February 2, 2026, the market movements of a year ago highlight a critical turning point in the artificial intelligence revolution. On February 10, 2025, NVIDIA Corporation (NASDAQ: NVDA) shares surged nearly 3%, closing in the $133 range and effectively ending a period of intense market anxiety

Via MarketMinute · February 2, 2026

Advanced Micro Devices has ripped higher ahead of its Q4 release on Feb. 3, but options traders are convinced AMD stock will push further up after earnings this week.

Via Barchart.com · February 2, 2026

As of February 2, 2026, the artificial intelligence landscape has reached a pivotal milestone, driven largely by the massive industrial deployment of NVIDIA’s Blackwell architecture. What began as a bold promise in late 2024 has matured into the undisputed backbone of the global AI economy. The Blackwell platform, specifically the flagship GB200 NVL72, has bridged [...]

Via TokenRing AI · February 2, 2026

In a dramatic reversal of fortunes that has sent ripples through the semiconductor industry, Intel Corporation (NASDAQ: INTC) has officially closed the book on the reliability crisis that haunted its 13th and 14th Generation processors. According to 2025 year-end data from premier system builders, Intel’s hardware reliability has reached statistical parity with its primary rival, [...]

Via TokenRing AI · February 2, 2026

In a move set to redefine the physical limits of artificial intelligence hardware, the United States and Japan have formalized a series of landmark agreements aimed at fortifying the semiconductor supply chain. At the heart of this alliance is a proposed $500 million synthetic diamond production facility in the U.S. and a comprehensive rare earth [...]

Via TokenRing AI · February 2, 2026

As of February 2, 2026, the global artificial intelligence landscape remains in the grip of an "AI super-cycle," where the ability to deploy large-scale models is limited not by software ingenuity, but by the physical architecture of silicon. At the center of this storm is Taiwan Semiconductor Manufacturing Co. (NYSE: TSM), whose advanced packaging technology, [...]

Via TokenRing AI · February 2, 2026

In a move that signals a paradigm shift for the semiconductor industry, Ricursive Intelligence announced today, February 2, 2026, that it has closed a massive $300 million Series A funding round. The investment, led by Lightspeed Venture Partners, values the startup at an estimated $4 billion just two months after its public debut. This surge [...]

Via TokenRing AI · February 2, 2026

At the 2026 Consumer Electronics Show (CES), Qualcomm (NASDAQ: QCOM) solidified its position at the vanguard of the local AI revolution, announcing the new Snapdragon X2 Plus processor alongside a massive expansion into the burgeoning field of 'Physical AI.' Designed to bring flagship-level neural processing to the mainstream market, the Snapdragon X2 Plus serves as [...]

Via TokenRing AI · February 2, 2026

As of February 2, 2026, the semiconductor industry has reached a pivotal turning point, officially transitioning from the "Plastic Age" of chip packaging to the "Glass Age." For decades, organic materials like Ajinomoto Build-up Film (ABF) served as the foundation for the world’s processors, but the relentless thermal and density demands of generative AI have [...]

Via TokenRing AI · February 2, 2026