McKesson Corp (MCK)

957.80

+0.00 (0.00%)

NYSE · Last Trade: Feb 6th, 5:37 AM EST

Thursday's session: top gainers and losers in the S&P500 indexchartmill.com

Via Chartmill · February 5, 2026

Medline is an appealing investment candidate – it has solid growth, operates in a steady industry, and a storied history.

Via The Motley Fool · February 5, 2026

Healthcare distributor and services company McKesson (NYSE:MCK) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.4% year on year to $106.2 billion. Its non-GAAP profit of $9.34 per share was 0.7% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

McKesson (MCK) Q3 2026 Earnings Call Transcript

Via The Motley Fool · February 4, 2026

McKesson Corp (NYSE:MCK) Reports Mixed Q3 2026 Results and Raises Full-Year Profit Outlookchartmill.com

Via Chartmill · February 4, 2026

McKesson Corp (NYSE:MCK) Fits the 'Affordable Growth' Investment Profilechartmill.com

Via Chartmill · January 29, 2026

McKesson Corp (NYSE:MCK) Demonstrates Strong Growth and Technical Breakout Potentialchartmill.com

Via Chartmill · January 20, 2026

Healthcare distributor and services company McKesson (NYSE:MCK) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.4% year on year to $106.2 billion. Its non-GAAP profit of $9.34 per share was 0.7% above analysts’ consensus estimates.

Via StockStory · February 4, 2026

Healthcare distributor and services company McKesson (NYSE:MCK)

will be announcing earnings results this Wednesday after the bell. Here’s what to expect.

Via StockStory · February 2, 2026

An improving earnings profile, aggressive buybacks, and a renewed focus on margins might be changing how long-term investors think about this healthcare distributor.

Via The Motley Fool · December 29, 2025

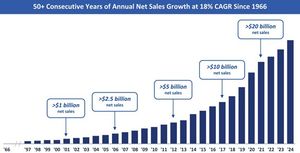

The global healthcare landscape shifted decisively on December 16, 2025, with the public market return of Medline Industries (Nasdaq: MDLN). After four years under the stewardship of a private equity consortium—and decades of private family ownership before that—the medical supply titan has reclaimed its status as a public entity in the largest U.S. initial public [...]

Via PredictStreet · December 18, 2025

McKesson Corp exemplifies GARP investing, offering strong earnings growth at a reasonable valuation within the vital healthcare supply chain.

Via Chartmill · December 26, 2025

Large-cap stocks are known for their staying power and ability to weather market storms better than smaller competitors.

However, their sheer size makes it more challenging to maintain high growth rates as they’ve already captured significant portions of their markets.

Via StockStory · December 23, 2025

McKesson trades at $825.38 and has moved in lockstep with the market. Its shares have returned 14.5% over the last six months while the S&P 500 has gained 12.9%.

Via StockStory · December 23, 2025

CRANFORD, NJ — As the 2025 calendar year draws to a close, Citius Oncology, Inc. (Nasdaq: CTOR) has reached a pivotal juncture in its corporate evolution. Following the release of its SEC 10-K filing for the fiscal year ended September 30, 2025, the company has officially shed its "development-stage" label, entering

Via MarketMinute · December 23, 2025

In a stunning return to the public stage, Medline Industries (Nasdaq: MDLN) successfully executed the largest initial public offering (IPO) in the United States since 2021, pricing its shares at the top of its range and witnessing a massive first-day "pop" that has sent ripples through the financial world. The

Via MarketMinute · December 18, 2025

McKesson Corp combines strong earnings growth with a bullish technical setup, offering a potential entry point in the healthcare sector.

Via Chartmill · December 17, 2025

The S&P 500 (^GSPC) is often seen as a benchmark for strong businesses, but that doesn’t mean every stock is worth owning.

Some companies face significant challenges, whether it’s stagnating growth, heavy debt, or disruptive new competitors.

Via StockStory · December 11, 2025

Growth is oxygen.

But when it evaporates, the consequences can be severe - ask anyone who bought Cisco in the Dot-Com Bubble or newer investors who lived through the 2020 to 2022 COVID cycle.

Via StockStory · December 9, 2025

Personal health and wellness is one of the many secular tailwinds for healthcare companies. Players catalyzing medical advancements have benefited from elevated demand, which has supported the industry’s returns lately -

over the past six months, healthcare stocks have gained 13.5%, nearly mirrorring the S&P 500.

Via StockStory · December 7, 2025

Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Wednesday.

Via Chartmill · December 3, 2025

Let's have a look at the top S&P500 gainers and losers one hour before the close of the markets of today's session.

Via Chartmill · December 2, 2025

Stay informed about the performance of the S&P500 index in the middle of the day on Tuesday. Uncover the top gainers and losers in today's session for valuable insights.

Via Chartmill · December 2, 2025

McKesson Corp exemplifies GARP investing, offering strong earnings growth at a reasonable valuation, backed by solid profitability and financial strength.

Via Chartmill · December 2, 2025

Free cash flow is one of the most reliable indicators of financial durability.

These businesses not only generate cash but reinvest intelligently to sustain momentum.

Via StockStory · December 1, 2025