Freeport-McMoRan (FCX)

60.76

+0.00 (0.00%)

NYSE · Last Trade: Feb 3rd, 7:27 AM EST

Detailed Quote

| Previous Close | 60.76 |

|---|---|

| Open | - |

| Bid | 63.40 |

| Ask | 63.59 |

| Day's Range | N/A - N/A |

| 52 Week Range | 27.66 - 69.44 |

| Volume | 98,046 |

| Market Cap | 89.20B |

| PE Ratio (TTM) | 49.40 |

| EPS (TTM) | 1.2 |

| Dividend & Yield | 0.6000 (0.99%) |

| 1 Month Average Volume | 25,339,196 |

Chart

About Freeport-McMoRan (FCX)

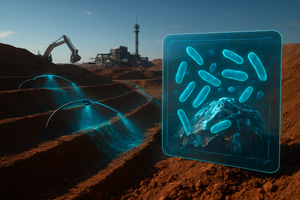

Freeport-McMoRan is a leading international mining company primarily engaged in the extraction and production of copper, gold, and molybdenum. The company operates large-scale mining operations in various regions, including North America and South America, where it focuses on delivering high-quality metal resources. Beyond mining, Freeport-McMoRan is involved in exploration activities to identify new mineral resources and employs innovative techniques to enhance sustainability and efficiency in its operations. The company's commitment to responsible resource development reflects its dedication to minimizing environmental impact while providing essential minerals that contribute to numerous industries worldwide. Read More

News & Press Releases

In a move that signals a seismic shift in American monetary policy, President Donald Trump officially announced on January 30, 2026, his intention to nominate Kevin Warsh to succeed Jerome Powell as Chairman of the Federal Reserve. The announcement, which came just months before Powell’s term is set to

Via MarketMinute · February 2, 2026

WASHINGTON, D.C. — In a move that has sent shockwaves through global financial corridors, President Donald Trump has officially nominated Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, which initially broke via the President's Truth Social account late Friday and resonated through the

Via MarketMinute · February 2, 2026

What's going on in today's pre-market session: S&P500 moverschartmill.com

Via Chartmill · January 26, 2026

The global copper market is currently grappling with a stark reality check as the "red metal"—long considered a primary barometer for global economic health—witnesses a significant retreat from its recent historic highs. On February 2, 2026, copper prices plummeted to approximately $5.60 per pound, marking a sharp

Via MarketMinute · February 2, 2026

Warsh’s Fed Pick Triggers a Metals Faceplantchartmill.com

Via Chartmill · February 2, 2026

The global precious metals market suffered its most violent "flash crash" in recent history today, January 30, 2026, as a "perfect storm" of hawkish U.S. monetary policy signals and massive technical liquidations erased months of gains in a matter of hours. Gold prices, which had reached a staggering peak

Via MarketMinute · January 30, 2026

Explore the top gainers and losers within the S&P500 index in today's session.chartmill.com

Via Chartmill · January 30, 2026

These S&P500 stocks are the most active in today's sessionchartmill.com

Via Chartmill · January 30, 2026

In a move that has sent shockwaves through global financial markets, President Donald Trump has officially nominated Kevin Warsh to succeed Jerome Powell as the next Chairman of the Federal Reserve. The announcement, made on the morning of January 30, 2026, marks the culmination of a year-long campaign by the

Via MarketMinute · January 30, 2026

What's going on in today's session: S&P500 moverschartmill.com

Via Chartmill · January 30, 2026

The global mining industry is bracing for a seismic shift as the February 5 deadline approaches for Rio Tinto (NYSE: RIO) to finalize its pursuit of Glencore (LSE: GLEN). This high-stakes corporate drama intensified this week following Glencore's release of its 2025 production results, which revealed a sharp 11% decline

Via MarketMinute · January 30, 2026

Which S&P500 stocks are gapping on Friday?chartmill.com

Via Chartmill · January 30, 2026

Investors are excited about the recent spike in copper prices.

Via The Motley Fool · January 30, 2026

These S&P500 stocks that are showing activity before the opening bell on Friday.chartmill.com

Via Chartmill · January 30, 2026

Veteran commodities analyst Ole Hansen of Saxo Bank highlighted multiple near-term supply and demand signals that don’t fully justify the rally.

Via Stocktwits · January 29, 2026

These S&P500 stocks have an unusual volume in today's sessionchartmill.com

Via Chartmill · January 29, 2026

These S&P500 stocks that are showing activity before the opening bell on Thursday.chartmill.com

Via Chartmill · January 29, 2026

Via MarketBeat · January 29, 2026

Copper is a key part of data center infrastructure necessary to support booming artificial intelligence (AI) growth.

Via The Motley Fool · January 29, 2026

Via MarketBeat · January 27, 2026

The global copper market has entered a transformative era, driven by a "perfect storm" of surging demand from artificial intelligence (AI) data centers and a series of catastrophic supply shocks at major traditional mines. As of late January 2026, copper prices have stabilized near a historic $5.91 per pound,

Via MarketMinute · January 27, 2026

As the first month of 2026 draws to a close, the financial landscape is witnessing a profound structural shift that many analysts are calling the 'Great Rotation.' After years of dominance by Silicon Valley and the banking elite, the pendulum of investor sentiment has swung back toward the tangible

Via MarketMinute · January 26, 2026

What's going on in today's session: S&P500 most active stockschartmill.com

Via Chartmill · January 26, 2026

Discover which S&P500 stocks are making waves on Monday.chartmill.com

Via Chartmill · January 26, 2026