ICF International, Inc. - Common Stock (ICFI)

89.69

-4.08 (-4.35%)

NASDAQ · Last Trade: Feb 4th, 1:33 AM EST

Detailed Quote

| Previous Close | 93.77 |

|---|---|

| Open | 93.47 |

| Bid | 35.70 |

| Ask | 142.78 |

| Day's Range | 88.05 - 93.88 |

| 52 Week Range | 72.03 - 119.48 |

| Volume | 121,262 |

| Market Cap | 1.69B |

| PE Ratio (TTM) | 16.95 |

| EPS (TTM) | 5.3 |

| Dividend & Yield | 0.5600 (0.62%) |

| 1 Month Average Volume | 132,138 |

Chart

About ICF International, Inc. - Common Stock (ICFI)

ICF International is a consulting services company that provides a range of strategic and technical support services to government and commercial clients. The firm specializes in areas such as digital transformation, public health, energy efficiency, and environmental management, leveraging data analytics and technology to develop tailored solutions. ICF's services include program implementation, policy analysis, and stakeholder engagement, aiming to help clients tackle complex challenges and enhance performance across various sectors. With a strong focus on sustainability and social impact, the company works to drive positive outcomes for communities and organizations alike. Read More

News & Press Releases

ICF International trades at $91.37 and has moved in lockstep with the market. Its shares have returned 10.4% over the last six months while the S&P 500 has gained 9.6%.

Via StockStory · January 29, 2026

Business services providers play a critical role for enterprises, assisting them with everything from new hardware integrations to consulting and marketing. Furthermore, the demand for their offerings is rising as more clients outsource non-core functions,

a trend that has enabled the industry to return 11.8% over the past six months, almost identical to the S&P 500.

Via StockStory · January 15, 2026

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the government & technical consulting industry, including ICF International (NASDAQ:ICFI) and its peers.

Via StockStory · January 13, 2026

While strong cash flow is a key indicator of stability, it doesn’t always translate to superior returns.

Some cash-heavy businesses struggle with inefficient spending, slowing demand, or weak competitive positioning.

Via StockStory · December 30, 2025

As the digital age accelerates and artificial intelligence reshapes industries, the demand for electricity in the United States is poised for an unprecedented surge, with projections indicating a staggering 50% increase by 2050. At the epicenter of this energy transformation stands Willdan Group (NASDAQ: WLDN), a professional technical and consulting

Via MarketMinute · December 16, 2025

Shares of professional consulting firm ICF International (NASDAQ:ICFI) jumped 4.4% in the morning session after an analyst at Canaccord Genuity upgraded the company's stock rating to 'Buy' from 'Hold' and raised the price target. The price target was increased significantly to $115 from $90. The analyst firm expressed optimism about ICF International's outlook, pointing to a "likely return to growth in 2026, healthy FCF generation, and strong management" as key reasons for the improved rating. The firm noted that the current situation offered a chance to "own a high-quality growth asset at a reasonable price" following what was described as a difficult year for the company in 2025.

Via StockStory · December 2, 2025

Investors looking for hidden gems should keep an eye on small-cap stocks because they’re frequently overlooked by Wall Street.

Many opportunities exist in this part of the market, but it is also a high-risk, high-reward environment due to the lack of reliable analyst price targets.

Via StockStory · December 1, 2025

The stocks in this article have caught Wall Street’s attention in a big way, with price targets implying returns above 20%.

But investors should take these forecasts with a grain of salt because analysts typically say nice things about companies so their firms can win business in other product lines like M&A advisory.

Via StockStory · November 25, 2025

Stability is great, but low-volatility stocks may struggle to deliver market-beating returns over time as they sometimes underperform during bull markets.

Via StockStory · November 12, 2025

Business services providers thrive by solving complex operational challenges for their clients, allowing them to focus on their secret sauce. But increasing competition from AI-driven upstarts has tempered enthusiasm,

limiting the industry’s gains to 15.4% over the past six months.

This return lagged the S&P 500’s 18.6% climb.

Via StockStory · November 7, 2025

ICF International’s third quarter was marked by weaker results versus Wall Street expectations, driven primarily by a sharp decline in federal government revenues. Management pointed to delays in ramping up international government contracts and a slowdown in federal procurement and project activities, especially in public health and human services ahead of the government shutdown. CEO John Wasson noted that commercial, state, local, and international government clients now represent 57% of total revenue, up from 46% last year, as these segments posted growth while federal revenues dropped.

Via StockStory · November 6, 2025

ICF International (ICFI) Q3 2025 Earnings Call Transcript

Via The Motley Fool · November 1, 2025

Shares of professional consulting firm ICF International (NASDAQ:ICFI) fell 6.3% in the afternoon session after the company reported disappointing third-quarter financial results that missed analyst expectations for both revenue and earnings. The professional consulting firm's revenue fell 10% year-on-year to $465.4 million, missing the consensus estimate of $484.2 million. Adjusted earnings per share also came in below forecasts at $1.67, compared to the anticipated $1.73. This bottom-line miss was notable as it represented a significant drop from the $2.13 in adjusted EPS reported in the same quarter last year. Overall, the soft results on both the top and bottom lines disappointed investors, leading to the sell-off.

Via StockStory · October 31, 2025

Professional consulting firm ICF International (NASDAQ:ICFI) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 10% year on year to $465.4 million. Its non-GAAP profit of $1.67 per share was 3.7% below analysts’ consensus estimates.

Via StockStory · October 30, 2025

ICF International (ICFI) missed Q3 2025 earnings and revenue estimates. Despite the miss, the company highlighted strong growth in its commercial and international government segments.

Via Chartmill · October 30, 2025

Professional consulting firm ICF International (NASDAQ:ICFI) will be reporting earnings this Thursday after market hours. Here’s what investors should know.

Via StockStory · October 28, 2025

Via Benzinga · October 27, 2025

Generating cash is essential for any business, but not all cash-rich companies are great investments.

Some produce plenty of cash but fail to allocate it effectively, leading to missed opportunities.

Via StockStory · October 20, 2025

Not all profitable companies are built to last - some rely on outdated models or unsustainable advantages.

Just because a business is in the green today doesn’t mean it will thrive tomorrow.

Via StockStory · October 17, 2025

ICF International excels with a 40.95% ROIC, strong cash flow, and steady profit growth, making it a standout quality investment.

Via Chartmill · October 16, 2025

A number of stocks fell in the afternoon session after the U.S. government shutdown halted the release of crucial economic data, creating uncertainty for investors and policymakers.

Via StockStory · October 9, 2025

Value stocks typically trade at discounts to the broader market, offering patient investors the opportunity to buy businesses when they’re out of favor.

The key risk, however, is that these stocks are usually cheap for a reason – five cents for a piece of fruit may seem like a great deal until you find out it’s rotten.

Via StockStory · October 1, 2025

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how ICF International (NASDAQ:ICFI) and the rest of the government & technical consulting stocks fared in Q2.

Via StockStory · September 29, 2025

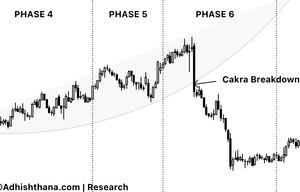

Adhishthana.com research outlines why ICF International's 45% drop may only be the beginning of a long bearish cycle.

Via Benzinga · September 24, 2025