Water and fire protection solutions company Core & Main (NYSE:CNM) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 11.5% year on year to $2.04 billion. The company’s full-year revenue guidance of $7.4 billion at the midpoint came in 0.9% above analysts’ estimates. Its GAAP profit of $0.69 per share was in line with analysts’ consensus estimates.

Is now the time to buy Core & Main? Find out by accessing our full research report, it’s free.

Core & Main (CNM) Q3 CY2024 Highlights:

- Revenue: $2.04 billion vs analyst estimates of $1.99 billion (11.5% year-on-year growth, 2.3% beat)

- Adjusted EPS: $0.69 vs analyst estimates of $0.68 (in line)

- Adjusted EBITDA: $277 million vs analyst estimates of $262 million (13.6% margin, 5.7% beat)

- The company slightly lifted its revenue guidance for the full year to $7.4 billion at the midpoint from $7.35 billion

- EBITDA guidance for the full year is $925 million at the midpoint, above analyst estimates of $914.4 million

- Operating Margin: 10.9%, in line with the same quarter last year

- Free Cash Flow Margin: 12.4%, down from 19.3% in the same quarter last year

- Market Capitalization: $9.30 billion

"We delivered strong performance in the third quarter, including record quarterly sales and Adjusted EBITDA, demonstrating that Core & Main can grow in any environment," said Steve LeClair, chair and CEO of Core & Main.

Company Overview

Formerly a division of industrial distributor HD Supply, Core & Main (NYSE:CNM) is a provider of water, wastewater, and fire protection products and services.

Infrastructure Distributors

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

Sales Growth

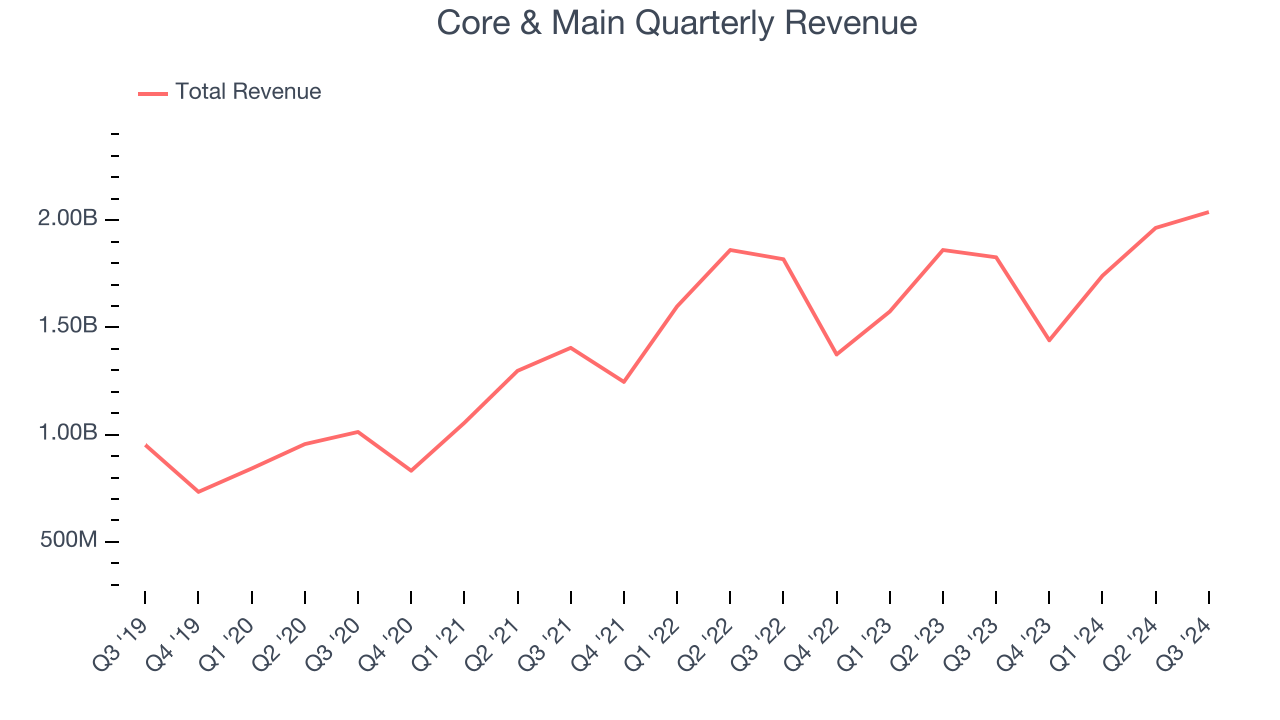

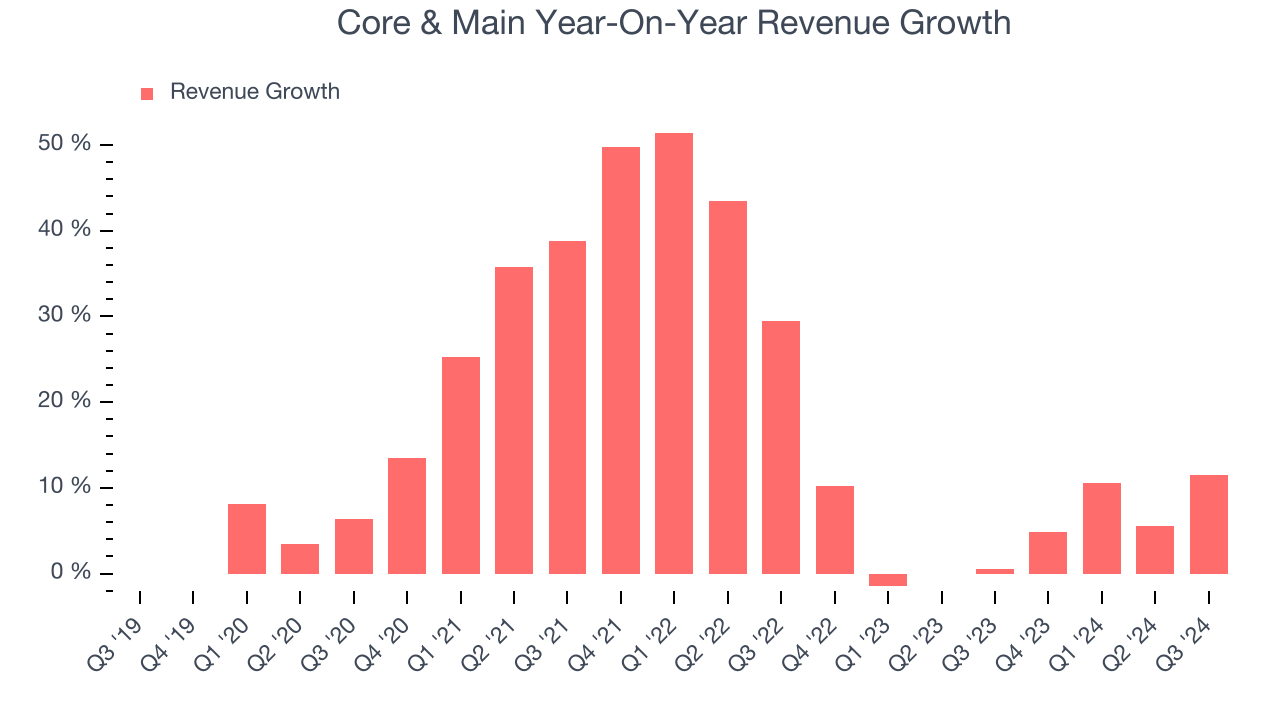

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Core & Main grew its sales at an incredible 16.2% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Core & Main’s recent history shows its demand slowed significantly as its annualized revenue growth of 4.9% over the last two years is well below its five-year trend.

This quarter, Core & Main reported year-on-year revenue growth of 11.5%, and its $2.04 billion of revenue exceeded Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, similar to its two-year rate. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

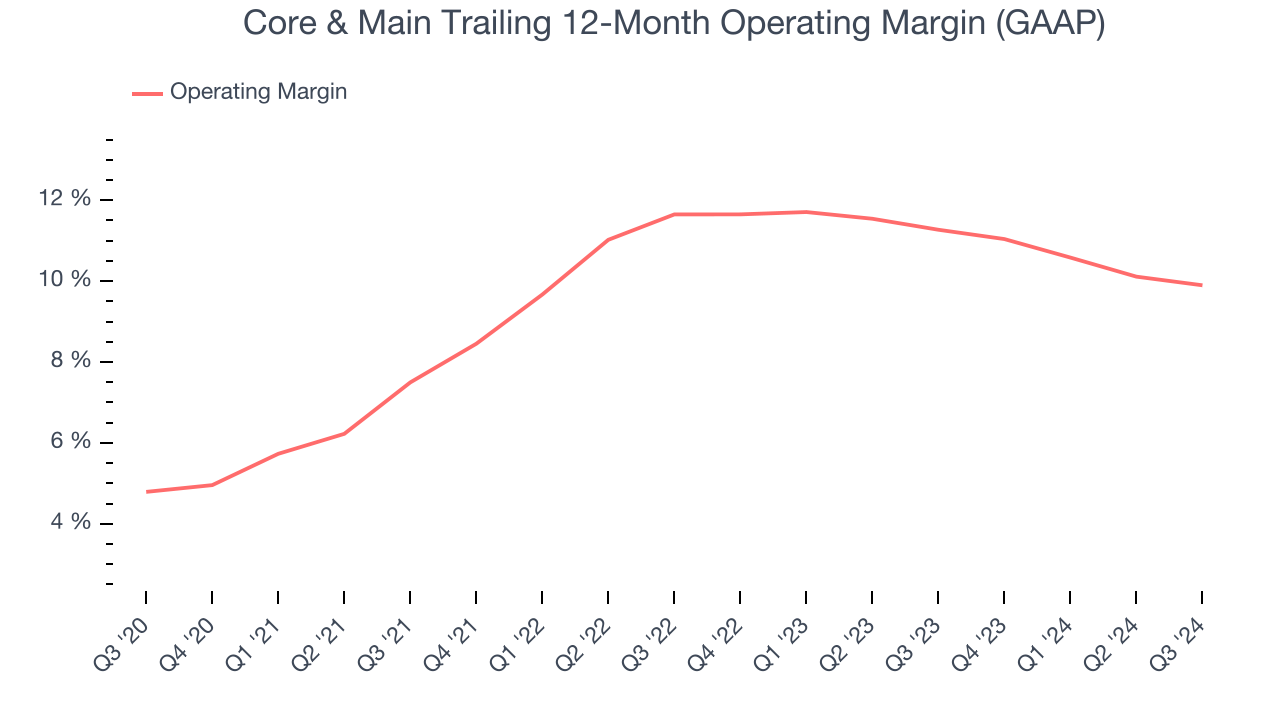

Core & Main has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.6%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Core & Main’s operating margin rose by 5.1 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Core & Main generated an operating profit margin of 10.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

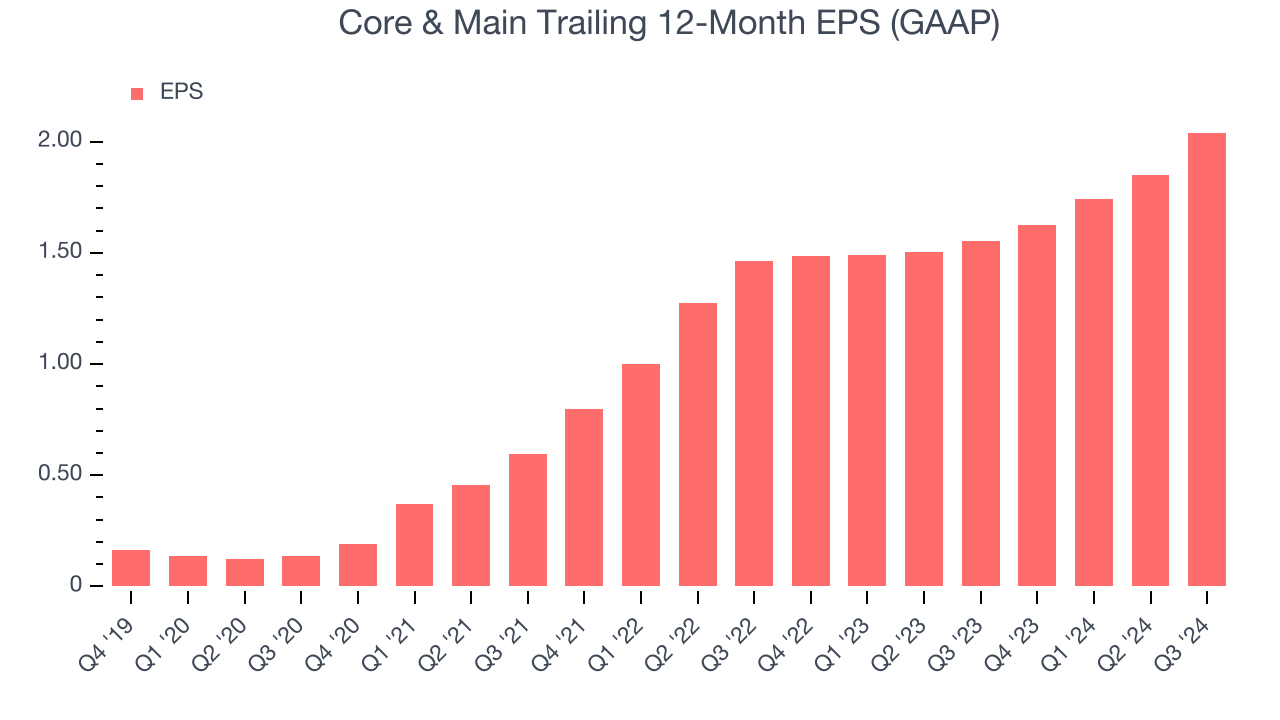

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

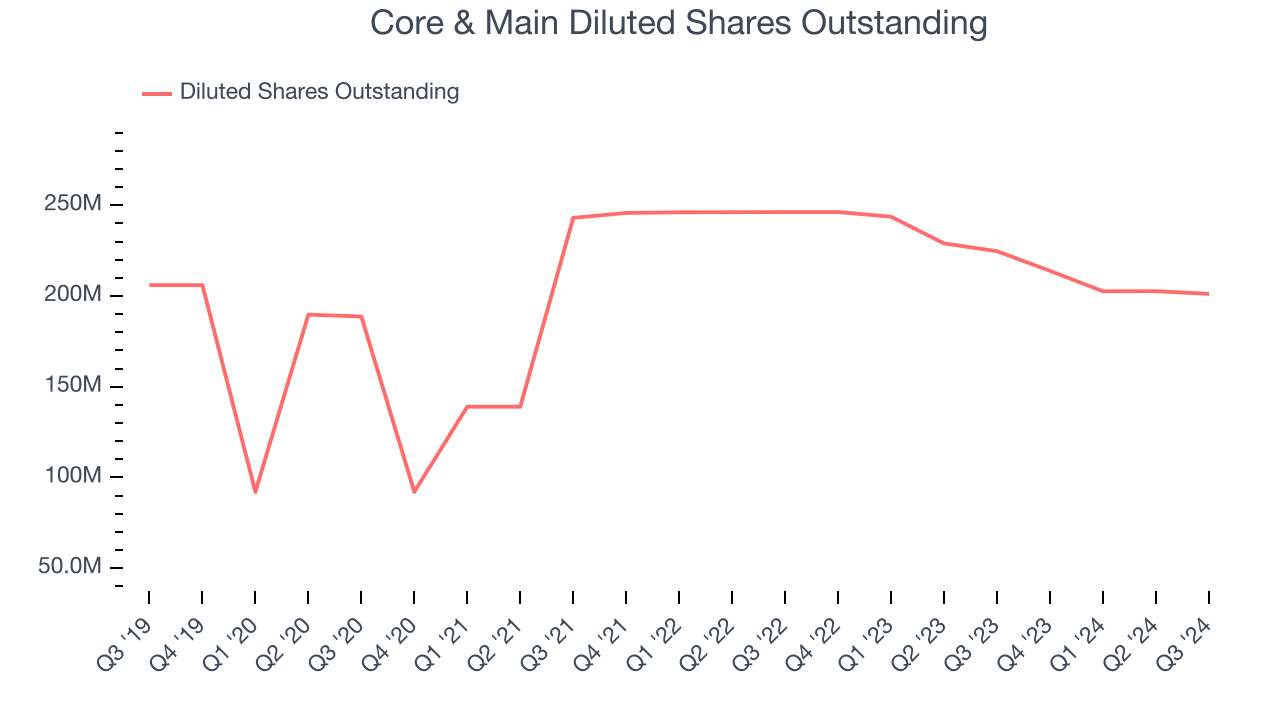

Core & Main’s EPS grew at an astounding 50% compounded annual growth rate over the last five years, higher than its 16.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Core & Main’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Core & Main’s operating margin was flat this quarter but expanded by 5.1 percentage points over the last five years. On top of that, its share count shrank by 2.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Core & Main, its two-year annual EPS growth of 18.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, Core & Main reported EPS at $0.69, up from $0.50 in the same quarter last year. This print beat analysts’ estimates by 1%. Over the next 12 months, Wall Street expects Core & Main’s full-year EPS of $2.04 to grow 19.7%.

Key Takeaways from Core & Main’s Q3 Results

We enjoyed seeing Core & Main exceed analysts’ revenue and EBITDA expectations this quarter. Full year revenue guidance was raised and full year EBITDA guidance came in ahead of expectation, which are signs of a healthy business. Overall, we think this was a strong quarter. The stock traded up 8.8% to $52.52 immediately after reporting.

Core & Main had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.