After seven years, over 3,350 patent and patent-pending claims, and more than $1 billion, AST SpaceMobile Inc. (NASDAQ: ASTS) finally launched its Block 1 first five Bluebird satellites on September 12, 2024. The launch went without a hitch, and the satellites are now in low earth orbit. AST SpaceMobile plans to offer the world's first and only space-based satellite cellular broadband network. This computer and technology sector pioneer will be the first to offer direct-to-device 4G and 5G cellar service for off-the-shelf smartphones. It ultimately wants to cover every inch of the planet and eliminate any more dropped calls due to connectivity gaps among mobile network operators (MNOs).

Over 45 Telecom Companies Are on Board With AST SpaceMobile

This will take 168 satellites and up to $5 billion to achieve. The company has signed revenue-sharing deals and memorandum of understanding (MOUs) with over 40 MNOs, including a six-year commercial agreement with a $20 million revenue commitment with AT&T Inc. (NYSE: T), a $100 million deal with Verizon Communications Inc. (NYSE: VZ) and a $25 million revenue commitment from Vodafone Group Public Ltd. Co. (NASDAQ: VOD) with a combined cell phone customer base of 2.8 billion users.

AST SpaceMobile Wants a Piece of the $67 Billion Pie by 2032

The global mobile wireless market is $1.1 trillion, with 5.6 billion phones and devices that move in and out of coverage. As big as your local cellular coverage may seem, the reality is that 42% of the global population is without cellular broadband coverage. Nearly 90% of the earth's surface is without cellular coverage. Nearly 3.4 billion people do not belong to a cellular broadband service. AST SpaceMobile expects the eight-year demand for satellite direct-to-device communications will be $67 billion.

AST SpaceMobile Launches Block 1 Satellites for Nationwide Coverage

With the successful launch of its Block 1 Bluebird satellites, the company is able to provide non-continuous nationwide coverage for the United States, with over 5,600 cells in premium low-spectrum orbit. AT&T and Verizon will get the first crack at the network in upcoming beta tests. In order to provide continuous coverage of the United States with voice, text, and data, AST SpaceMobile will need up to 60 satellites, which, at $30 million each, would require up to $1.8 billion in total. While the initial Block 1 satellites cost $5 million each, the costs will come down with each launch.

Did AST SpaceMobile Pull a Bait-and-Switch?

The $11.50 per share conversion price on 17.6 million warrants became active after its stock traded above the $18.00 level for 20 out of 30 days. This generates another $155 million from warrant redemptions, bringing its total cash position to nearly $440 million. Incidentally, the company announced that it may sell up to $400 million of stock in an at-the-market (ATM) offering.

This threw investors for a loop, considering the company stated it had no plans for a stock offering in 2024, which caused its stock to dump by 27%. However, the ATM offering can happen periodically, at any time, up to three years after the 8-K SEC filing on September 5, 2024. Therefore, AST SpaceMobile could wait until 2025 to sell shares.

AST SpaceMobile Builds Up Its War Chest

Nonetheless, this could boost its cash position to $840 million, depending on when it follows through with the sales. This is more than enough to launch its Block 2 constellation of 17 Bluebird satellites at up to $30 million each, which would cost a total of $510 million. Block 2 Bluebirds are larger and more powerful, outfitted with hi-house application-specific integrated circuit (ASIC) processors capable of 10 GHz processing bandwidth and 10x more capacity than the initial Block 1 satellites. AST SpaceMobile plans to launch the first of its Block 2 satellites in the first quarter of 2025.

Upcoming Catalysts for AST SpaceMobile

Now that the first satellites are in orbit, investors will be waiting for updates or news about beta tests, commercialization, FCC approvals, new launch dates for the Block 2 Bluebirds, or new deals with telecoms and MNOs. Any of these can trigger higher stock prices and analyst upgrades.

On September 3, 2024, Deutsche Bank reiterated its Buy rating and $63 target on ASTS shares. The successful launch of Block 1 prompted Scotiabank to reaffirm its Sector Outperform rating with a $45.90 price target on September 13, 2024. AST SpaceMobile’s average consensus price target is $43.73, and its highest analyst price target is $63.00.

AST SpaceMobile’s third-quarter of 2024 earnings report is due on November 11, 2024.

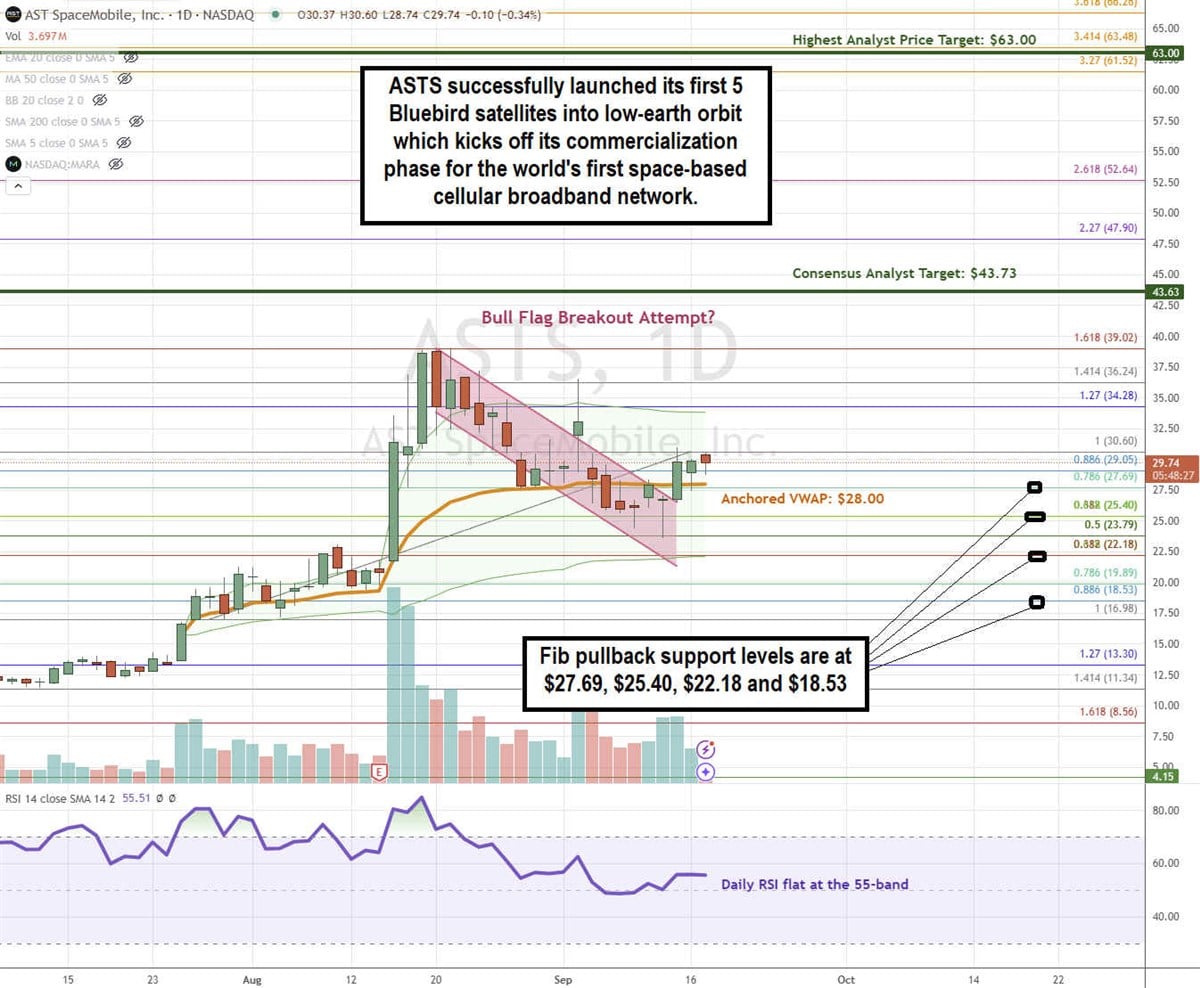

ASTS Stock May Be Setting Up a Bull Flag Pattern

After a sharp and steep rise in a stock price, a flag pattern forms on the pullback comprised of parallel descending upper and descending lower trendlines indicating lower highs and lower lows. The bull flag breakout triggers when shares break out higher through the upper trendline.

ASTS formed its flag after peaking at $39.02, indicating lower highs and lower lows as shares pulled back to a low of $23.79 on the $400 million ATM offering filing. ASTS shares bounced back above the anchored VWAP at $28.00 after its successful launch on September 12, 2024, with Block 1 satellites. The market awaits more news or updates on commercialization as a catalyst for price action. The daily relative strength index (RSI) is flat around the 55-band. Fibonacci (Fib) pullback support levels are at $27.69, $25.40, $22.18, and $18.53.

Bullish investors can buy on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls to execute a wheel strategy for income.

Investors may consider buying LEAPS at Fib extension levels to capture the upside without deploying the full capital of owning the stock. If the LEAPS are deep in the money (ITM), selling front-month out-of-the-money calls activates a Poor Man’s Covered Call strategy to generate income.

Bullish options investors can limit maximum downside and profit from potential stock price gains with less capital than owning the stock by implementing a bullish call debit spread.