What a fantastic six months it’s been for DoorDash. Shares of the company have skyrocketed 59.7%, hitting $176.98. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is DASH a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On DoorDash?

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NYSE:DASH) operates an on-demand food delivery platform.

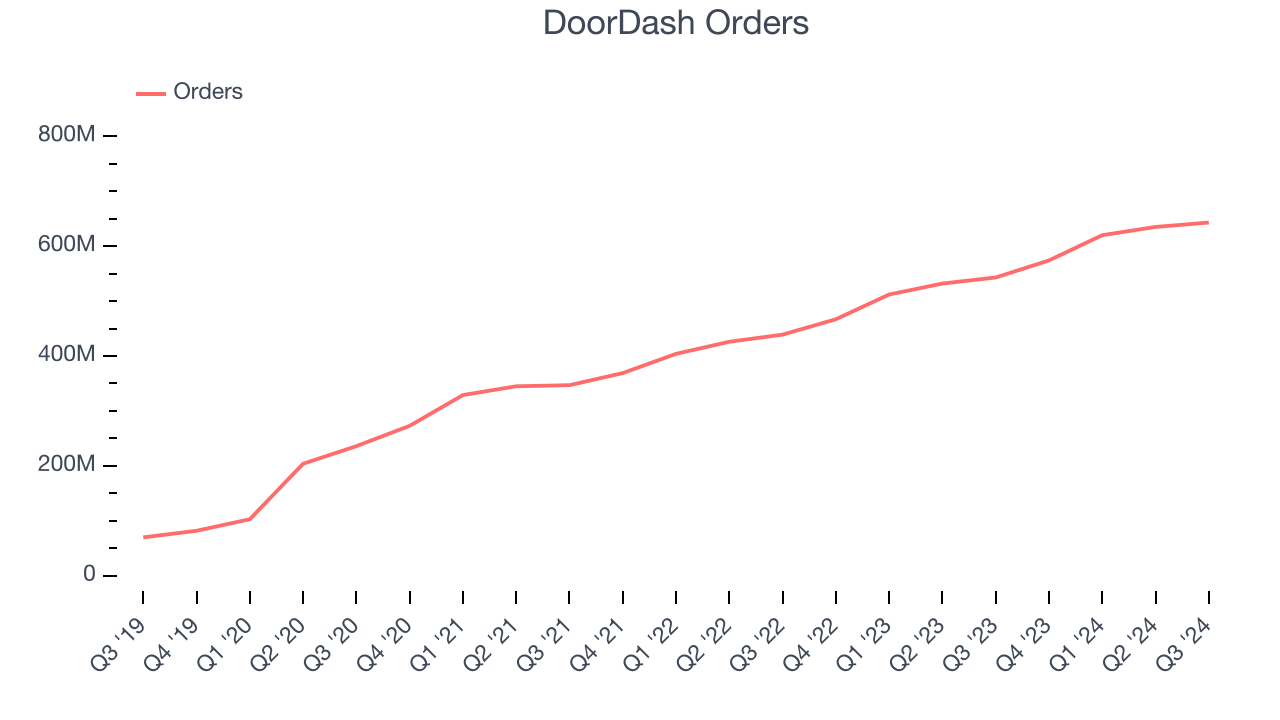

1. Orders Skyrocket, Fueling Growth Opportunities

As a gig economy marketplace, DoorDash generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Over the last two years, DoorDash’s orders, a key performance metric for the company, increased by 23% annually to 643 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

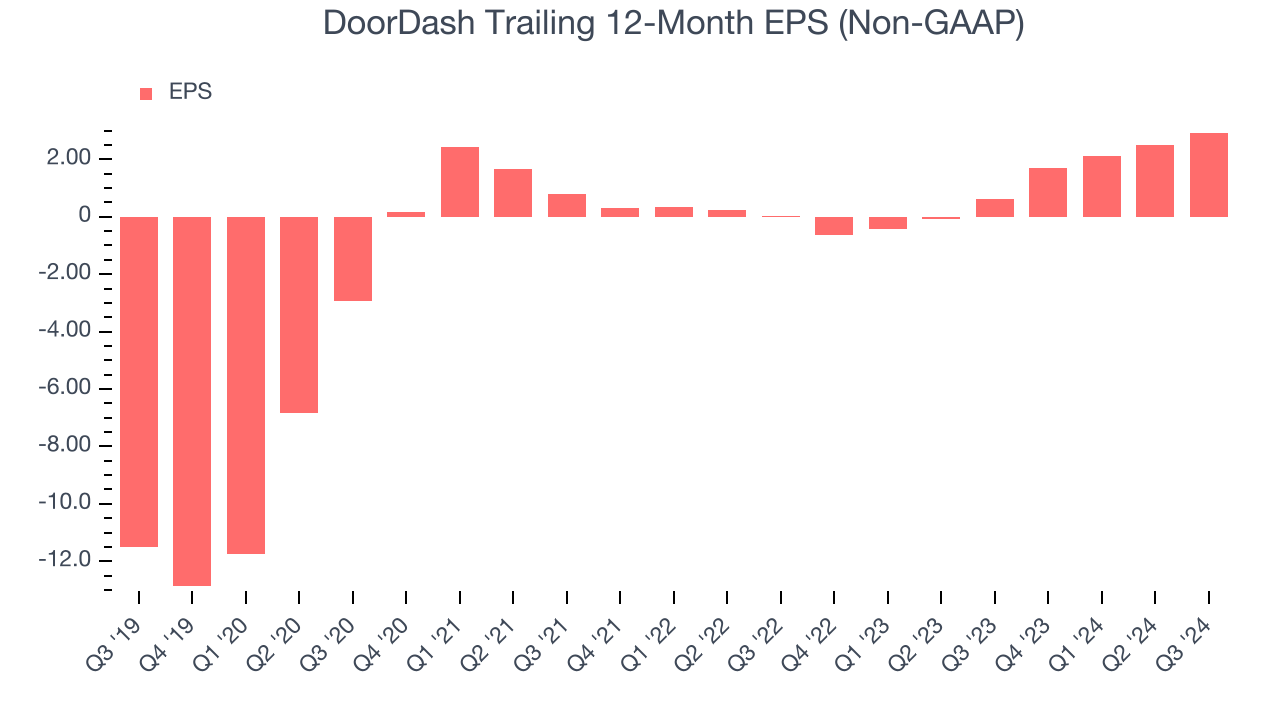

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

DoorDash’s EPS grew at an astounding 54.2% compounded annual growth rate over the last three years, higher than its 30.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

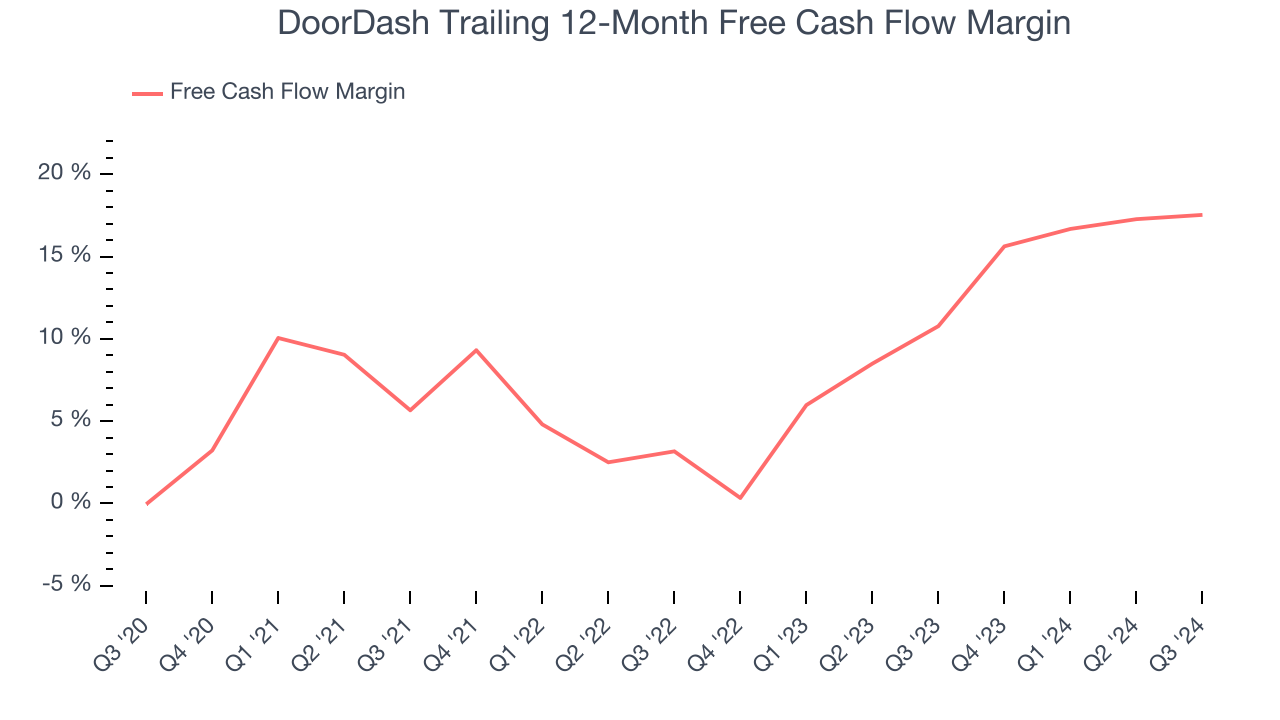

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, DoorDash’s margin expanded by 11.9 percentage points over the last few years. This is encouraging because its free cash flow profitability rose more than its operating profitability, suggesting it’s becoming a less capital-intensive business. DoorDash’s free cash flow margin for the trailing 12 months was 17.5%.

Final Judgment

These are just a few reasons why we think DoorDash is a great business, and after the recent surge, the stock trades at 32.1x forward EV-to-EBITDA (or $176.98 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than DoorDash

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.