Identity management software maker Okta (OKTA) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 13.9% year on year to $665 million. Guidance for next quarter’s revenue was optimistic at $668 million at the midpoint, 2.7% above analysts’ estimates. Its non-GAAP profit of $0.67 per share was 14.8% above analysts’ consensus estimates.

Is now the time to buy Okta? Find out by accessing our full research report, it’s free.

Okta (OKTA) Q3 CY2024 Highlights:

- Revenue: $665 million vs analyst estimates of $649.6 million (13.9% year-on-year growth, 2.4% beat)

- Adjusted EPS: $0.67 vs analyst estimates of $0.58 (14.8% beat)

- Adjusted Operating Income: $138 million vs analyst estimates of $120.2 million (20.8% margin, 14.8% beat)

- Revenue Guidance for Q4 CY2024 is $668 million at the midpoint, above analyst estimates of $650.7 million

- Management raised its full-year Adjusted EPS guidance to $2.76 at the midpoint, a 5.8% increase

- Operating Margin: -2.4%, up from -19% in the same quarter last year

- Free Cash Flow Margin: 23.2%, up from 12.1% in the previous quarter

- Market Capitalization: $13.73 billion

Company Overview

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ:OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Identity Management

As software penetrates corporate life, employees are using more apps every day, on more devices, in more locations. This drives the need for identity and access management software that help companies efficiently manage who has access to what, and ensure that access privileges are secure from cyber criminals.

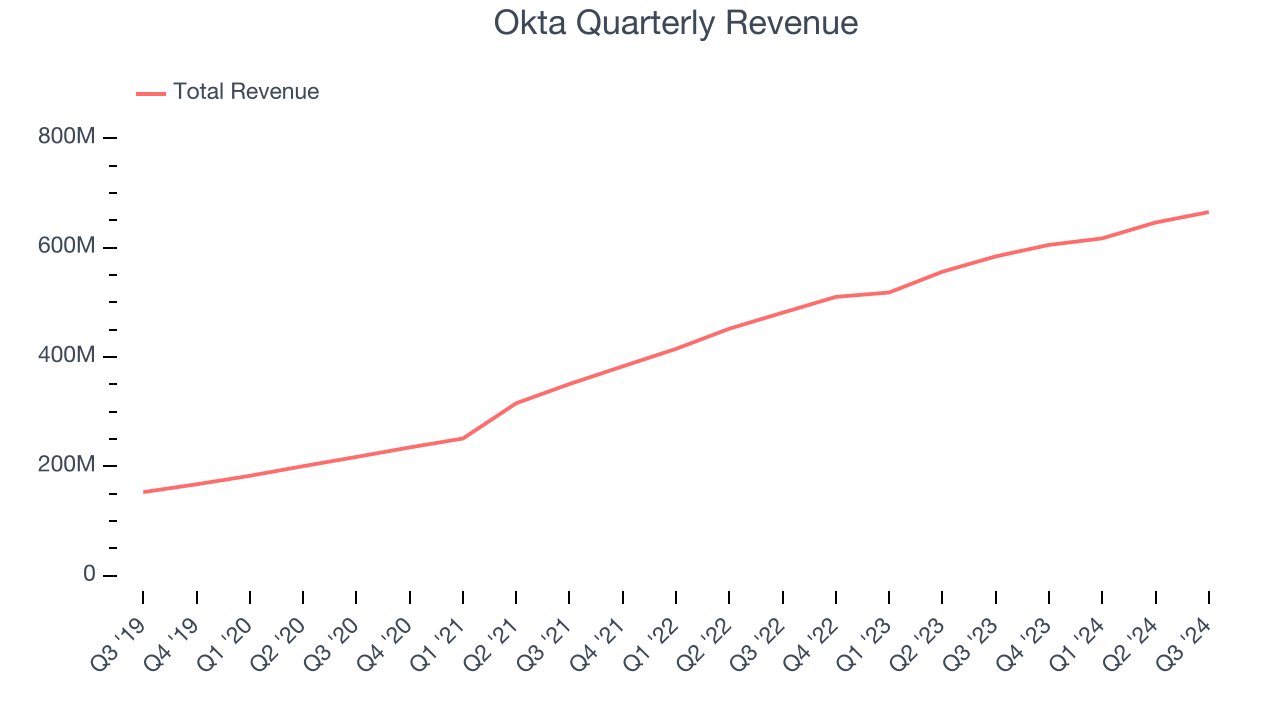

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Okta grew its sales at an impressive 30% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Okta reported year-on-year revenue growth of 13.9%, and its $665 million of revenue exceeded Wall Street’s estimates by 2.4%. Company management is currently guiding for a 10.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

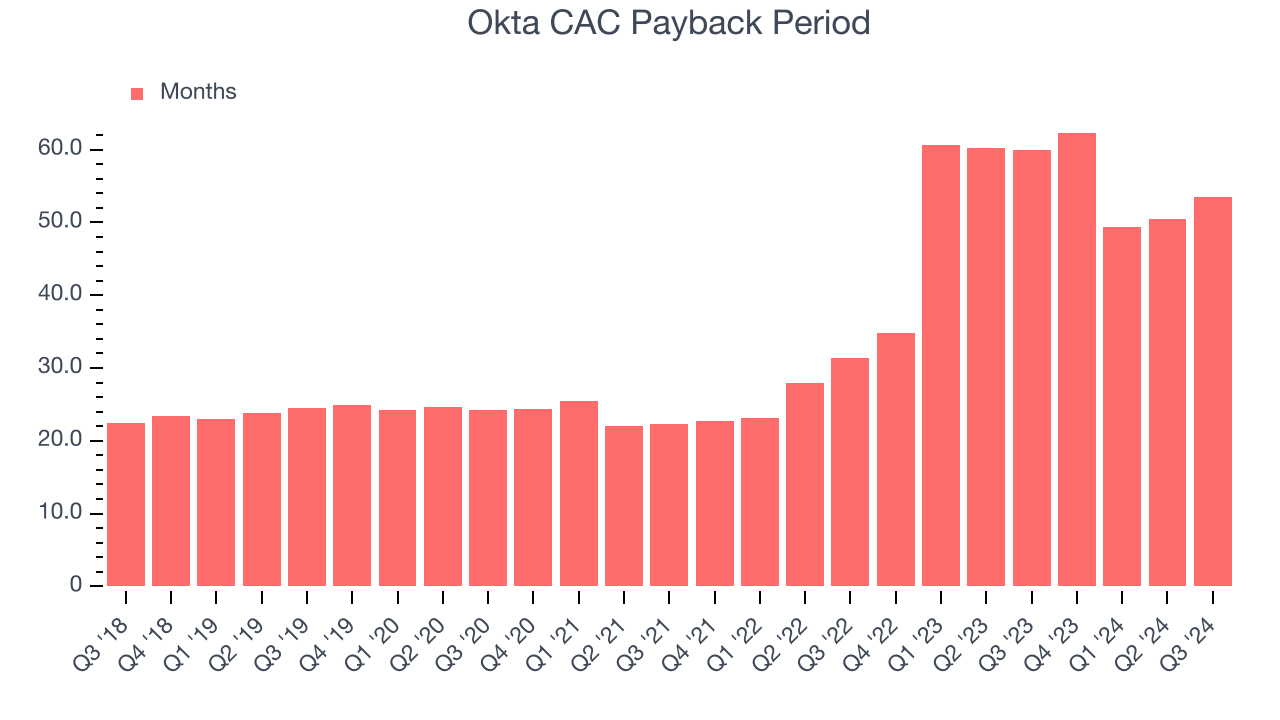

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Okta to acquire new customers as its CAC payback period checked in at 53.5 months this quarter. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from Okta’s Q3 Results

It was great to see Okta raise its full-year EPS guidance and beat analysts' full-year revenue guidance expectations. We were also glad this quarter's revenue and EPS came in much higher than Wall Street’s estimates. Zooming out, we think this was a solid "beat-and-raise" quarter. The stock traded up 19.7% to $97.86 immediately after reporting.

Okta put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.